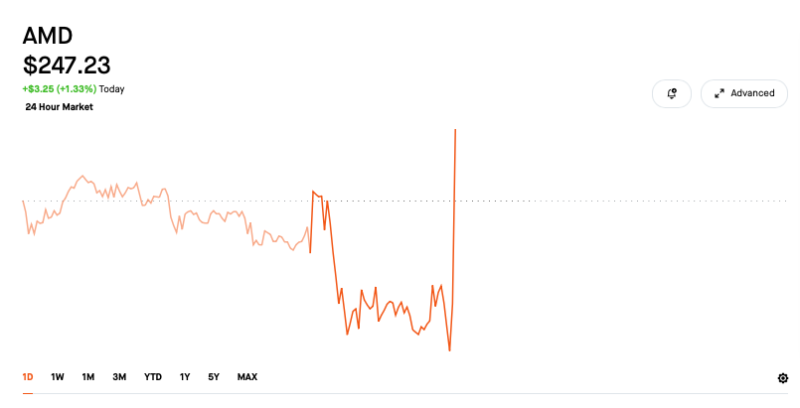

⬤ AMD's price shot up suddenly during intraday trading, showing a steep vertical spike on the chart. The stock briefly pushed toward $247 after a period of choppy movement, and the sharp candle clearly stood out—pointing to a quick burst of buying that lifted AMD above its recent range before settling back down.

⬤ While there wasn't an obvious news catalyst, the broader market backdrop includes ongoing talks about potential corporate tax changes that could impact high-growth sectors. Though not aimed specifically at AMD or semiconductors, these proposals—if enacted—could add operational costs, pressure smaller firms, and potentially shift where talent and capital flow. It's the kind of regulatory uncertainty that tends to linger in the background, even when short-term price moves seem unrelated.

⬤ The chart tells the story clearly: a downward intraday drift gets interrupted by an isolated vertical surge, then the price stabilizes near where it started. For traders watching closely, this looks more like algorithmic activity or a large order hitting the market than a sentiment-driven rally. No major headlines, just a sudden liquidity event that moved the needle fast.

⬤ As semiconductor and AI stocks continue drawing heavy interest, these kinds of volatile intraday swings are becoming more common. AMD remains a favorite among momentum traders and institutions, but the policy chatter around taxes adds another layer of unpredictability. For now, the spike reinforces that AMD is highly sensitive to market microstructure—technical reactions can appear out of nowhere, even when the news cycle is quiet.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets