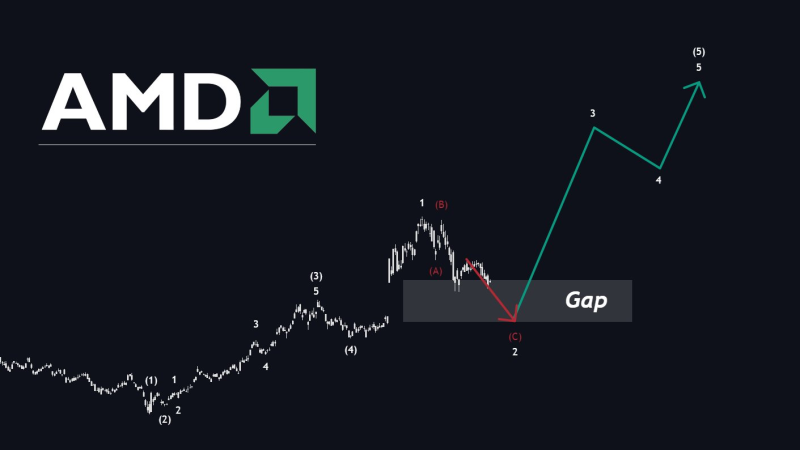

⬤ Advanced Micro Devices is drawing attention after earnings created a noticeable price gap on the charts. Analysts note these gaps rarely stay open forever, though the overall technical picture still looks healthy. The current pullback is testing that gap zone, but it's happening within what appears to be a broader upward trend rather than signaling any major reversal.

⬤ The technical setup shows AMD retracing after a strong rally, now moving back toward the gap area left from earnings volatility. These gaps typically become points where the market re-evaluates pricing after dramatic moves. What's encouraging is that despite the recent weakness, the stock hasn't broken down from its earlier uptrend and remains within the established trading structure.

⬤ Chart projections suggest the current weakness might wrap up near the gap zone before AMD potentially resumes its climb. The wave patterns and directional markers point to this dip being temporary within a larger bullish framework. Analysts are maintaining their mid-term positive stance with the next upside target pegged above $344, though some choppiness is expected as the stock works through this gap area.

⬤ This matters beyond just AMD shareholders since the stock serves as a bellwether for the semiconductor sector and broader tech sentiment. How it handles key technical levels like this earnings gap often influences expectations across the chip space. If AMD stabilizes and bounces from here, it would validate the bullish structure. A deeper slide would suggest a more cautious approach is warranted. For now, the gap remains the key feature traders are watching to gauge near-term direction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah