Options traders piled into AMD today with unusual conviction. The aggressive positioning points to mounting confidence in AMD's trajectory as AI chip demand accelerates.

What the Numbers Show

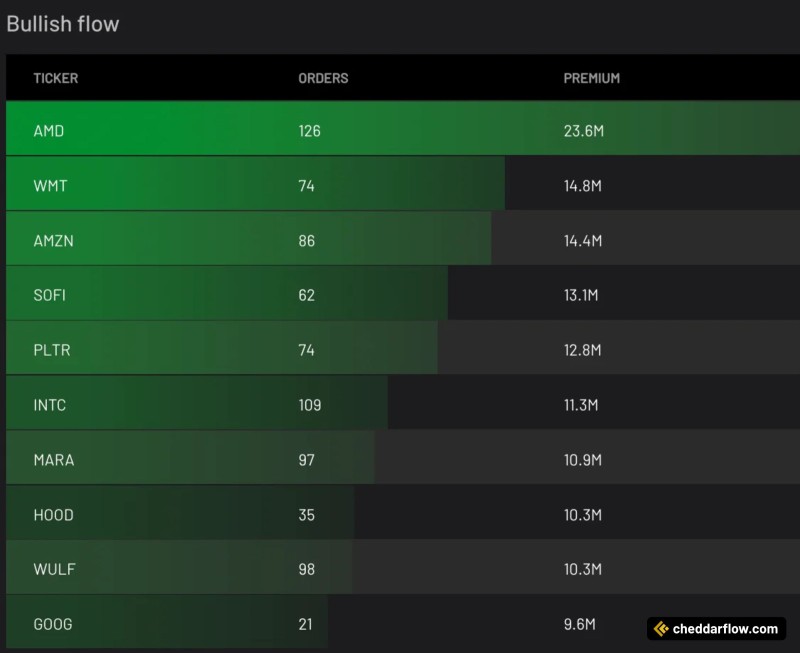

Fresh data from Cheddar Flow shows Advanced Micro Devices pulled in $23.6 million in bullish premium across 126 orders, easily outpacing household names like Walmart, Amazon, and Google. AMD commanded the top spot with 126 bullish orders totaling $23.6M in premium, the highest inflow tracked for the day. Walmart followed with 74 orders at $14.8M, Amazon logged 86 orders at $14.4M, SoFi saw 62 orders at $13.1M, and Palantir recorded 74 orders at $12.8M. Even Google, with just 21 orders, registered $9.6M in premium. The spread makes it clear: semiconductors are drawing the heaviest interest right now.

Why Traders Are Betting on AMD

AMD's surge in options flow mirrors the broader scramble for AI infrastructure. As companies rush to secure cutting-edge GPUs, AMD is increasingly seen as the credible alternative to Nvidia, both in performance and supply. Recent product rollouts and growing institutional backing seem to be fueling the momentum.

The data also reveals diversified bullish sentiment. Walmart and Amazon continue to attract steady interest, suggesting optimism around consumer spending and e-commerce resilience. Meanwhile, crypto-linked stocks like MARA and WULF each pulled in over $10M in premium, hinting at renewed appetite for blockchain exposure as digital assets heat up again.

AMD's dominance in today's bullish flow reflects strong conviction that the stock has room to run, especially as AI remains the defining growth story of 2025. That said, heavy options activity often signals incoming volatility, so traders should watch for potential swings as momentum builds.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets