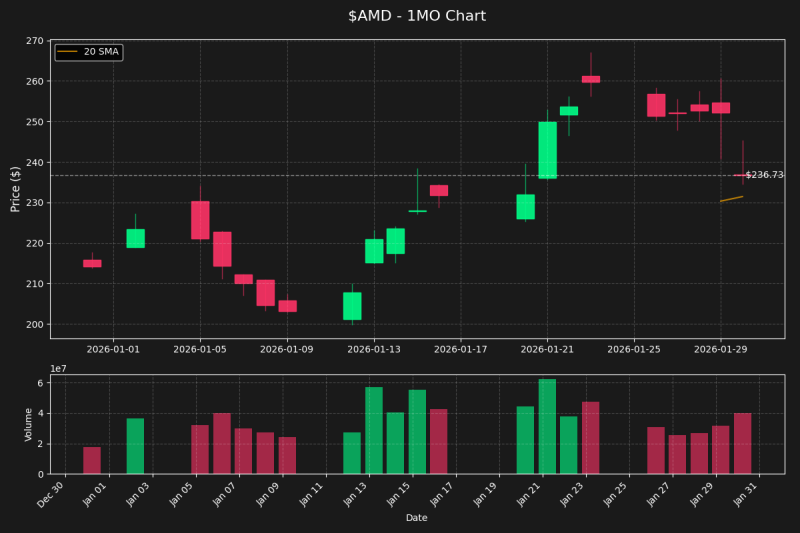

⬤ AMD wrapped up January trading around $236.73, still riding the momentum from a solid recovery earlier in the month. The stock bottomed out near $200 in mid-January, then rallied hard before pulling back into the mid-$230s. It's not a sharp drop — more of a pause after a big move up. The stock is still sitting above its rising 20-day moving average, which is a decent sign for short-term momentum.

⬤ Here's the thing — the actual price action tells a pretty clean story. AMD climbed from roughly $201 all the way up to intramonth highs above $260 before settling back. Volume picked up noticeably during that push through the $220–$230 range, then tapered off as the stock consolidated. That kind of volume pattern usually points to a digestion phase, not a breakdown.

⬤ The two levels everyone's watching are $266.96 on the upside and $199.80 below. Resistance at $267 is where the recent rally stalled, and support around $200 is where buying stepped in earlier this month. Right now AMD is sitting right in the middle of that range — which keeps things open in both directions.

⬤ AMD matters beyond its own chart because it's one of the most closely watched semiconductor names, and the sector tends to move with it. As long as it holds above $200 and keeps consolidating cleanly, the broader tech and chip sector narrative stays intact. The next real move — up or down — will likely set the tone for short-term momentum across semiconductors.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah