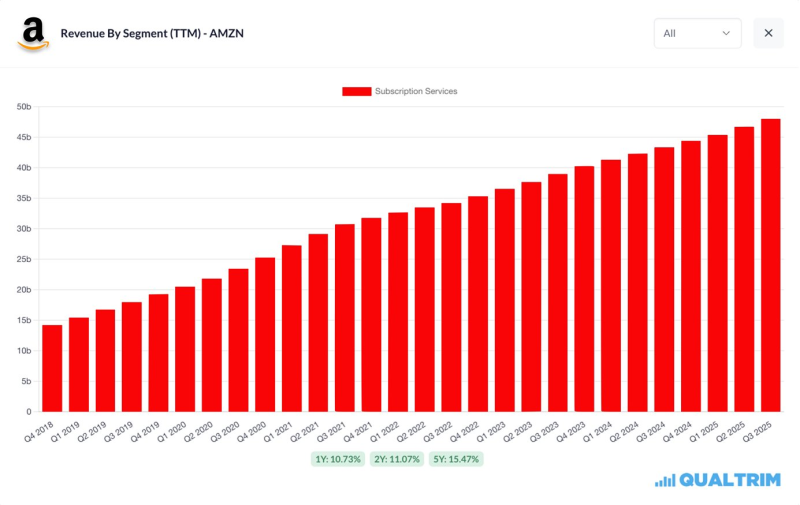

⬤ Amazon's subscription services have quietly become a revenue powerhouse, pulling in close to $48 billion over the past twelve months. That's bigger than roughly 81% of all Fortune 500 companies by revenue. What started at around $14 billion back in 2018 has grown steadily every quarter, showing just how much people value their Prime memberships and other subscription offerings.

⬤ The growth pattern tells an interesting story. Quarter after quarter, the numbers keep climbing without any major setbacks. By late 2025, subscriptions are pushing toward the $50 billion mark—territory you'd expect from a major standalone corporation, not just one piece of Amazon's business.

⬤ What makes subscription revenue particularly valuable is its predictability. Unlike one-time purchases, recurring subscriptions provide steady, reliable income that weathers market ups and downs. The consistent growth across one-year, two-year, and five-year periods shows this isn't a flash-in-the-pan trend—it's a fundamental shift in how Amazon makes money.

⬤ For investors and market watchers, this matters because it changes how we should think about Amazon. The company isn't just an e-commerce giant anymore—it's also running a subscription business bigger than most major corporations. As this segment continues expanding, it's reshaping Amazon's financial profile and strengthening its position against both tech rivals and traditional Fortune 500 companies.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi