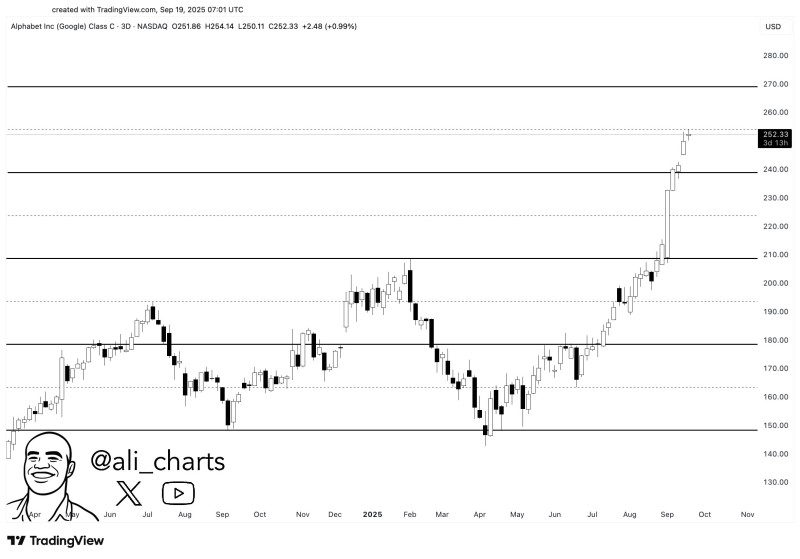

Alphabet stock is on a tear, breaking through major resistance levels and trading above $250 for the first time in years. With bullish momentum accelerating, investors now have their eyes on the next big target at $270. The breakout highlights both strong technical structure and rising investor confidence in Google's growth prospects.

Alphabet Stock Chart Analysis: Clean Breakouts Drive Higher

As Ali trader notes, the 3-day candlestick chart shows a clear bullish trend with GOOG breaking through key barriers at $210, $230, and $240, confirming strong upside momentum. At $252.33, shares are consolidating just below $255, with little resistance until the $270 level.

Key support now sits at $240, followed by $210 from earlier 2025 price action. The near-vertical move since August highlights aggressive buying pressure, marking Alphabet's strongest breakout since its 2023–24 consolidation phase and underscoring renewed demand for mega-cap tech.

Drivers Behind Alphabet's Rally

Several factors are fueling this impressive run. Alphabet's ongoing leadership in AI models and infrastructure strengthens its competitive position, while a rebound in digital advertising has bolstered earnings. Google Cloud's continued growth is supporting margins, and the broader risk-on sentiment in big tech stocks is reinforcing Alphabet's upward momentum.

Key Levels to Watch

- Upside Target: $270 represents the next major resistance zone

- Support Levels: First support rests at $240, with $210 as deeper support if momentum fades

- Bullish Confirmation: A sustained close above $255 would reinforce the case for a move toward $270

Forward-Looking Takeaways

Alphabet's breakout above $250 confirms bulls are in control. The bullish case remains intact as long as the stock holds above $240, with a break above $255 potentially accelerating the push toward $270. However, a reversal below $240 would signal overextension and could trigger a correction back to $210.

With fundamentals and technicals aligned, Google stock looks well-positioned to challenge the $270 mark in the weeks ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis