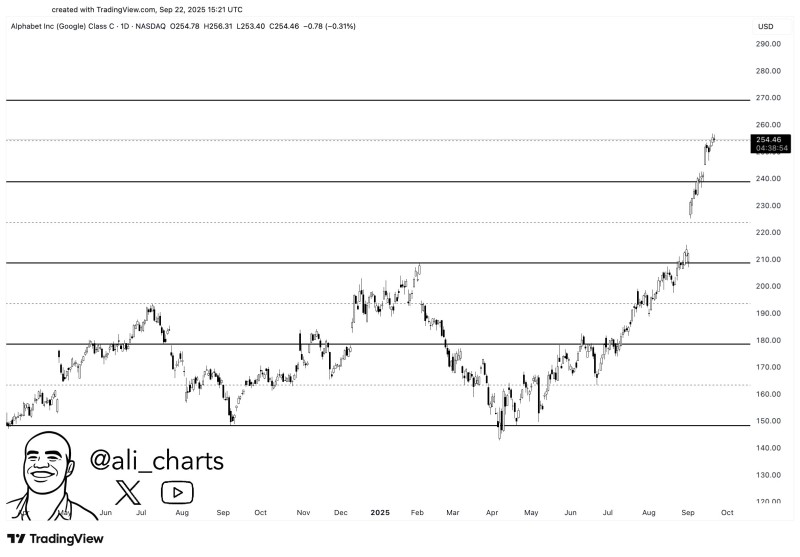

Alphabet (GOOG) stock has delivered an impressive rally, surging from around $150 earlier this year to over $250 by September 2025. This upward trajectory reflects growing investor confidence in AI-driven revenue opportunities, recovering advertising markets, and broader tech sector strength.

The stock's near-parabolic rise since summer has captured attention, but this rapid pace also signals potential short-term volatility ahead. $270 represents the next significant hurdle, where we might see substantial profit-taking after such a dramatic climb.

Technical Picture: Strong Momentum Faces Key Test

Looking at the daily chart, several important technical factors stand out. Alphabet currently trades at $254.46 after touching a daily peak of $256.31. As trader Ali notes, the stock now faces its most important test at the $260-$270 resistance zone, which has historically acted as a significant barrier.

The rally gains credibility from confirmed breakouts above former resistance levels at $210 and $230, both of which now provide solid support foundations. However, the nearly vertical nature of this advance since summer creates both opportunities and risks for traders positioning around current levels.

Fundamental Drivers Behind the Rally

Google's aggressive push into artificial intelligence across its Search and Cloud platforms has sparked genuine excitement about future growth prospects. The company's advertising business is showing clear signs of recovery after weathering previous headwinds, adding another layer of fundamental support.

The broader technology sector continues attracting heavy institutional investment flows, with Alphabet benefiting significantly from this favorable environment. These combined factors have created a compelling narrative that's driving sustained buying interest.

What's Next: Breaking Through or Pulling Back?

A successful break above $270 could open the door to further gains toward $290-$300, where the next meaningful resistance likely resides. Conversely, if the current resistance proves too strong, expect a potential retracement to the $240-$230 support zone as traders book profits.

The stock maintains its bullish character for now, but approaching such a critical technical level demands careful risk management. Sometimes the wisest strategy involves taking profits near resistance rather than pushing for the last dollar of potential gains.

Peter Smith

Peter Smith

Peter Smith

Peter Smith