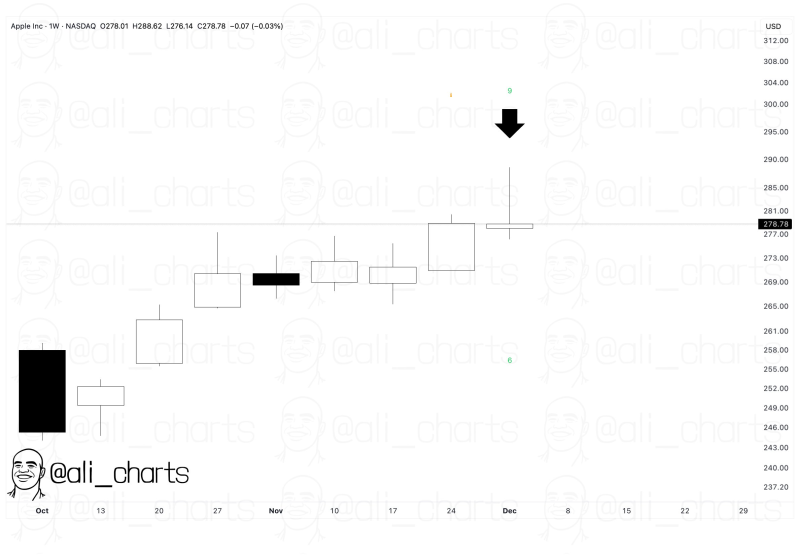

⬤ Apple's stock now faces a week that looks difficult. The weekly chart has fired a TD Sequential sell signal, which tells us the rally appears to run low on fuel. The chart shows a finished 9-count - that count normally means the present trend grows weak. Apple closed the week near $278, down a bare 0.03 % and price action already hesitates at those levels.

⬤ The TD Sequential pattern on the weekly timeframe of AAPL warns of a likely reversal. The candles that led to this signal rose in an even climb that has now stopped - the latest bar reached almost $281 before it pulled back. The setup carries a plain warning that downward movement may start soon. Across a wider view, Apple has traded inside a tight range during November before it met resistance.

The TD Sequential pattern on the AAPL weekly timeframe points to a possible reversal attempt.

⬤ This alert follows weeks of choppy trading in which AAPL failed to break through resistance in a decisive way. The weekly candles show doubt - long wicks tell us buyers keep getting turned away at higher prices. The TD Sequential, a well liked tool for locating turns, suggests momentum will fade unless buyers return. Apple has moved between about $276 and $289 recently - the signal serves as a reminder that more sideways trade or a drop may arrive.

⬤ Apple holds large sway over the market and pushes the Nasdaq hard. If AAPL slips on the back of this TD Sequential signal, the move could disturb the wider tech group and stir volatility across the main indexes. Traders will watch to see whether this technical warning unfolds and what it implies for large cap tech names ahead.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova