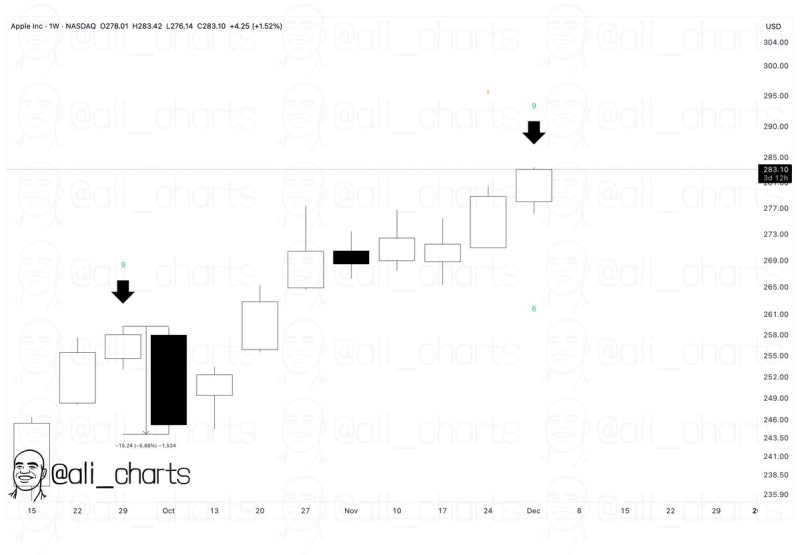

⬤ Apple pushed into new all-time territory this week, with AAPL trading around 283.10 and posting a weekly gain of roughly 1.52 percent. But the rally may be running out of steam—at least temporarily. The weekly TD Sequential indicator just completed a 9-count, a classic technical setup that often signals exhaustion and precedes periods of consolidation or profit-taking.

⬤ The chart shows two key TD 9 signals this year: one earlier that marked the start of a multi-week decline, and a fresh one forming right now near the latest peak. "The presence of a TD Sequential exhaustion signal at elevated levels typically encourages caution," especially when recent weekly candles show upper wicks like the ones currently visible. Translation: buyers might be losing their grip near these fresh highs.

⬤ That said, AAPL hasn't broken down. The stock is still holding above major support levels and maintaining its long-term uptrend with higher highs and higher lows intact. There's no confirmed reversal here—just a warning sign that momentum could cool off in the short term.

⬤ Why does this matter? Apple is a heavyweight in U.S. equity markets, and when AAPL shifts gears, the broader tech sector tends to follow. With a fresh TD 9 signal flashing at record levels, traders will be watching closely to see if the stock takes a breather or powers through to keep the rally alive.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets