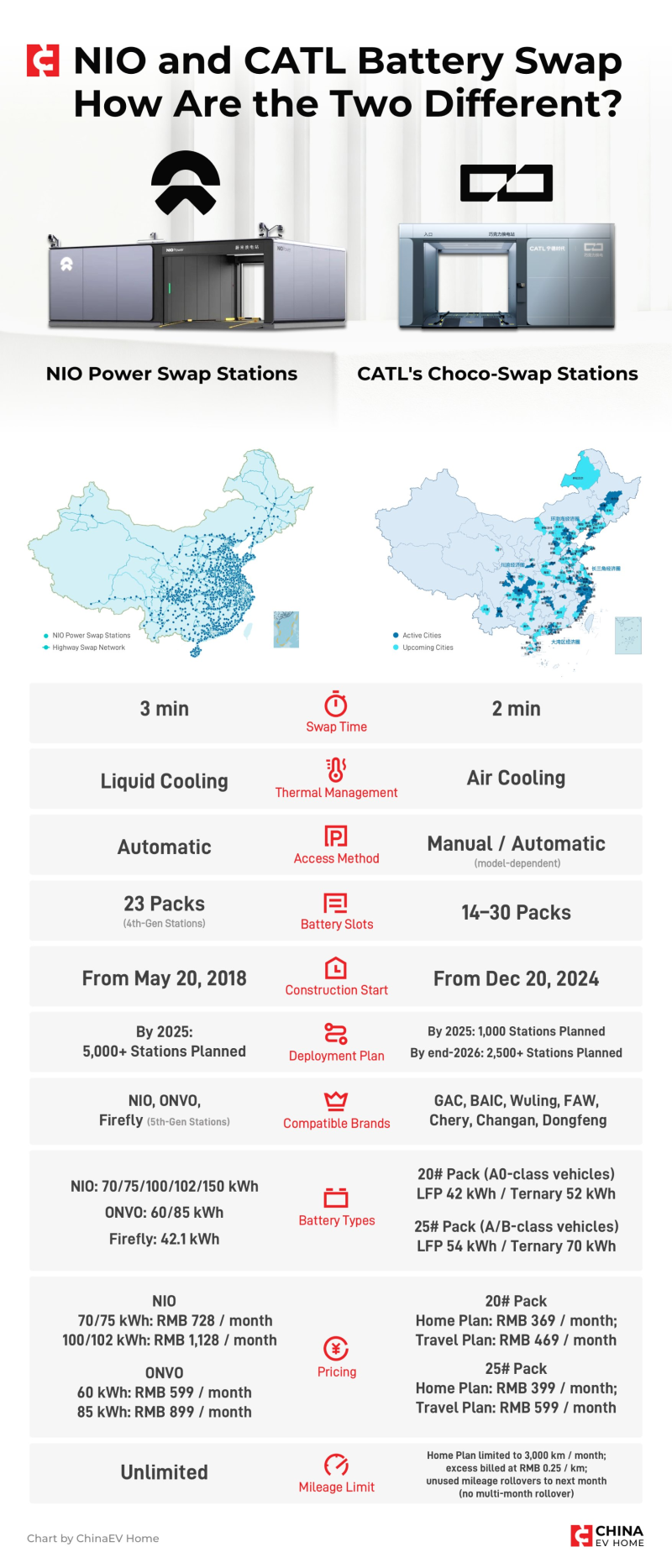

⬤ China's battery swapping market is taking off as major players roll out stations across the country. NIO and CATL have emerged as the two biggest names, but they're going about it in totally different ways. The data shows clear contrasts between NIO's Power Swap Stations and CATL's Choco-Swap Stations - everything from how long a swap takes to cooling tech, station size and which car brands can actually use them.

⬤ NIO has already put up 3,574 battery swap stations, with 1,003 sitting along highways. The company's hitting the brakes on its fourth-gen stations while gearing up for a massive fifth-gen rollout and Firefly vehicle compatibility coming in early 2026. The network is packed tight in central and eastern China, showing NIO's focus on going deep rather than wide. These stations handle the whole swap automatically, use liquid-cooled battery packs and can hold anywhere from 14 to 23 batteries depending on which generation you're looking at, working with multiple NIO and ONVO pack types.

⬤ CATL's Choco-Swap network started with commercial fleets but has jumped into the consumer space through deals like the one with Aion UT. Right now CATL runs about 800 stations, wants to hit 1,000 by year-end 2025 and is shooting for over 2,500 in 2026, with a crazy long-term target of 30,000 stations. CATL's playing a different game - spreading out geographically and working with tons of brands including GAC, Chery, Changan, FAW and BAIC. Their stations use air cooling instead of liquid, offer both manual and automatic options depending on your car, and pack in 14 to 30 batteries based on vehicle class.

⬤ What NIO and CATL are doing shows two completely different visions for battery swapping's future in China. NIO's building a tight, vertically locked-down network around its own cars, while CATL's creating an open platform that any automaker can plug into. As both networks grow, how density and reach play off each other could reshape how people adopt the tech and whether these systems stay separate or start merging into something bigger across China's EV landscape.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi