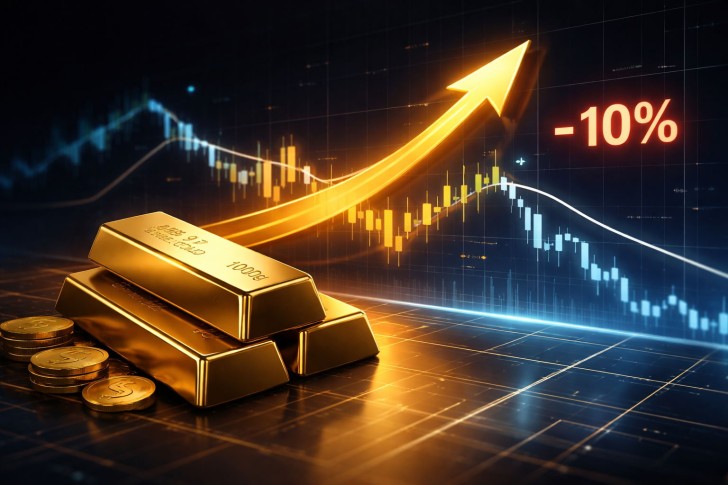

⬤ XAU gold has rallied hard this year while the US Dollar Index took a beating. The dollar lost about 10 percent of its value in 2025, with the index sitting down roughly 8.7 percent year to date through December 19. The chart shows a steady slide from January with only occasional breathers along the way.

⬤ When gold and silver both rocket higher while the dollar tanks, it's usually a sign that people are losing faith in the currency. Central banks are spreading their reserves around, and traders are putting on hedges. The parallel moves between precious metals and the dollar aren't random—they're telling us something about where confidence is heading.

⬤ The US is carrying around 38 trillion dollars in government debt right now. That kind of weight makes it tough to turn this ship around, and it feeds into bigger worries about whether the dollar can hold its value. The bottom line? This setup isn't good at all.

⬤ Gold tends to shine when faith in paper money starts to crack. If the Dollar Index keeps sliding and gold demand stays hot, we're looking at more hedging and growing caution across markets. Watching how the dollar and precious metals move together will give us a clear read on where sentiment stands as we head into the new year.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi