Have you ever noticed that you took a look at your paycheck and said, Where did all my money go? Your real income is often a mystery between the taxes, deductions, and insurance. That is precisely the point where PayCalculator.ai comes in - an intelligent, artificially intelligent device that can immediately tell you how much of your earnings you really get to take home at the end of the day after taxes. It breaks down bewildering numbers into easy answers in a few clicks, allowing you to plan your finances with ease at last.

Finally, a Salary Calculator That Makes Sense — Meet PayCalculator.ai

The pay calculator 2025 was created to provide any person with immediate information regarding income. It is an AI-based pay calculator 2025, which dissects your pay into components, so you can understand precisely how much you will take home after tax and other deductions.

The tool is oriented to employees, freelancers, and job seekers who prefer to compute net pay fast without using complex spreadsheets or estimations. All you need to do is add your salary, choose your state and filing, and any pre-tax deductions, and leave the AI to do the calculations.

Even better is that it has global coverage. Regardless of where you reside in the U.S., the U.K., Germany, France, or Japan, PayCalculator.ai will apply the latest tax information to make sure that all outcomes are based on actual values in 2025.

It has a clean and ad-free interface and is made to be precise, quick, and easy to use, thus a great companion to a modern professional.

Behind the Scenes: How PayCalculator.ai Calculates Your True Pay

PayCalculator.ai makes something that would normally require hours of research, a four-step process:

Step 1 - Enter Your Gross Salary

Enter your monthly or annual salary in the calculator.

Step 2 - Select State and Filing Status

Choose your residence and your tax filing status (single, married, etc.), as this influences the amount of tax you are required to pay.

Step 3 – Add Pre-Tax Deductions

Add any deductions like 401 (k) contributions, HSA deposits, or insurance premiums.

Step 4 – Get Your Take-Home Pay Breakdown

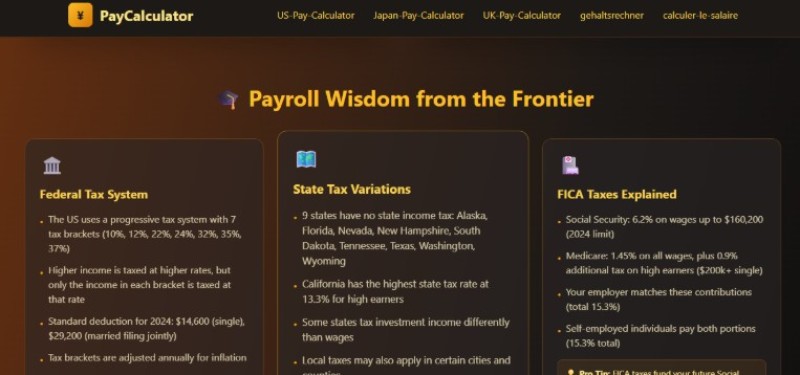

The tool shows you your federal tax, state tax, Social Security, Medicare, and other deductions in minutes - and your net salary and effective tax rate.

You may even compare outcomes across states or salary propositions, which gives you the entire openness prior to making career or relocation choices.

The PayCalculator.ai Advantage — Accuracy, Clarity, and AI Power Combined

Other online calculators provide a quick estimate, whereas PayCalculator.ai concentrates on the accuracy and details. It also keeps up to date with the current tax laws and rates in 2025, so that all the calculations remain correct.

The tool not only displays numbers, but also clarifies them. You may view the flow of your taxes and deductions on your final remuneration. It has a plain language AI-driven backend that understands complex tax systems, which makes it ideal for the users with minimal financial expertise.

Not to mention the fact that, as opposed to disorganized websites with advertisements, PayCalculator.ai is easy to navigate without any ads interrupting your concentration on what is important to you, your money.

Plan Smarter, Earn Smarter — Use PayCalculator.ai Today

Your salary is not supposed to be a lottery. PayCalculator.ai lets you get a crystal clear picture of your finances fast and correctly. This tool can be used to make well-informed decisions based on actual numbers, whether you are negotiating a raise, creating a budget, or weighing job opportunities.

Visit PayCalculator.ai today and know your real income in just a few seconds, no sign-ups, no puzzles, and no surprises. You should be in control of your paycheck and be able to plan your financial future.

Editorial staff

Editorial staff

Editorial staff

Editorial staff