MetaTrader 4 and 5 (MT4/MT5) have long been the standard platforms for forex and CFD trading worldwide, including US, United Kingdom and India. They offer customizable indicators, automated trading with Expert Advisors, and a basic strategy tester.

To truly optimize these features, especially for continuous automated trading and reliable backtesting, an MT5 VPS (Virtual Private Server) is essential. It provides a stable, 24/7 environment, overcoming internet or power outages, ensuring consistent performance for your EAs and detailed strategy analysis.

But for traders looking for deeper backtesting, stock support, or more user-friendly interfaces, MT4/MT5 can feel limited.

Why Look for MetaTrader Alternatives?

MetaTrader platforms are also less suited for all markets and equities, especially for traders focusing on NSE-listed stocks or who want to test strategies outside of forex.

This has pushed traders to explore other tools that offer more features, better data, and advanced strategy testing capabilities.

Thank you very much, here is the snippet below. Please send PayPal invoice:Backtesting MetaTrader alternatives works best when your environment mirrors production—consistent CPU/RAM, fast storage, and low-latency networking. Run your testbed on QuantVPS, where dedicated resources, NVMe storage, and 24/7 monitoring keep optimizations and walk-forward tests stable under load. For realistic simulations, pair your platform with clean tick data using this guide to the best sources for tick-aggregated futures data in 2025. Snapshot/clone workflows make it easy to A/B test builds and roll back safely, so what wins in testing is the exact configuration you can ship to live.

Here are three leading MetaTrader alternatives now gaining traction.

Forex Tester Online

Forex Tester Online is a powerful simulation platform designed for backtesting strategies on forex, stocks, and indices using real historical market conditions. If you look for better backtesting, FTO is a perfect MetaTrader alternative.

Unlike MetaTrader, which offers basic modeling for strategy testing, Forex Tester Online provides tick-by-tick price data going back 20+ years for over 200 assets — including global stocks like Tesla, Microsoft, and even some indices traders watch closely.

Features include:

- Tick-level data for accurate backtesting

- Simulated trading with commissions, spreads, and slippage

- One-click manual order execution for practice

- Risk management tools and synced chart views

It’s especially useful for traders who want to learn through real-time practice or refine strategies before risking live capital. The ability to test over many market cycles makes it ideal for swing and intraday strategies.

TradingView

TradingView is a web-based charting platform that’s already popular among retail traders. While it doesn’t offer traditional “playback” backtesting like Forex Tester, it does provide strong historical charting and script-based strategy testing through Pine Script.

It is not exactly like MetaTrader. It lacks some features that experienced traders like (or offer them at a huge price). But instead, it offers lots of other features that are not available on MT. Users benefit from:

- Real-time and historical data for NSE, BSE, and MCX

- Custom strategy creation using Pine Script

- Easy-to-share charts and community ideas

- Alerts and visual trade simulations

It’s more visual than MetaTrader and easier to use for beginners. While its backtesting isn't as detailed as Forex Tester, it allows traders to quickly test ideas and monitor multiple asset classes including stocks and crypto.

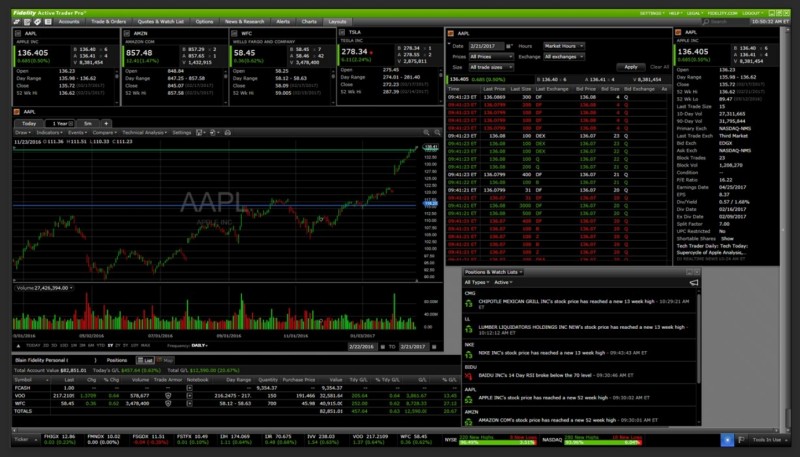

Active Trader Pro

Active Trader Pro by Fidelity is primarily a US-focused platform, but some traders with access to international markets or interest in global equities use it for its advanced tools. It is even more similar to MT than two previous tools.

Though not available natively in some countries, those with international brokerage accounts find its features useful:

- Advanced backtesting for technical strategies

- Real-time market data and deep chart analysis

- Trade execution with custom order settings

For traders seeking alternatives beyond traditional markets, this platform offers professional-level tools not found in MetaTrader.

Key Insights

So, basically, MetaTrader is a decent time-proven platform, but it’s not always the best fit. Especially for traders interested in NSE stocks, advanced backtesting, or a more modern interface. As an alternative, you may try:

- Forex Tester Online is ideal for traders who want hands-on backtesting experience with real historical data and trade simulation.

- TradingView is great for stock traders who want clean visuals, scripting, and community ideas.

- Active Trader Pro suits those with access to international equities and who need deep analysis tools.

For strategy-focused traders, exploring beyond MetaTrader could unlock better tools for smarter decisions.

Editorial staff

Editorial staff

Editorial staff

Editorial staff