It wasn’t about making quick money. I wanted to learn safely how orders, fees, and price swings actually work without burning my savings. Here’s the exact process I followed and what I wish I had known earlier.

Step 1: Start Small and Stay Curious

Crypto markets can be intimidating — charts move fast, and everyone seems to be “buying the dip.” Starting with $100 helped me focus on learning, not chasing profit.

I treated it like a hands-on course: a small, controlled experiment to understand risk, orders, and liquidity.

Step 2:Understand What You’re Trading

Cryptocurrency is digital money that lives on decentralized blockchains. The popular ones:

- Bitcoin (BTC) — the original digital asset.

- Ethereum (ETH) — runs smart contracts and decentralized apps.

- Stablecoins (USDT, USDC) — pegged to USD, ideal for trading pairs and avoiding volatility.

These are the currencies you’ll see most often paired on exchanges (BTC/USDT, ETH/USDT, etc.).

Step 3: Learn the Basics of Spot Trading

Your first $100 trade should be spot trading, not leverage or futures.

Here’s why:

- You own the crypto you buy.

- Your maximum loss = the amount you invested.

- It helps you focus on entries, exits, and timing - not liquidation prices.

Spot trading lets you buy Bitcoin or Ethereum at current prices and hold them directly in your wallet.

Step 4: Know Your Order Types

Most beginners lose money not because of bad timing, but because they use the wrong order type.

- Market order: Executes immediately but pays higher taker fees.

- Limit order: Executes only at your chosen price — often with 0% maker fee.

Tip: Always start with limit orders. They give you better control over pricing and help you avoid unnecessary fees.

Step 5: Place Your First Order

Example:

• Choose a pair - say ETH/USDT

• Set a limit buy order slightly below the market price (e.g., if ETH = $3,000, place at $2,980)

• Wait for it to fill

• Once filled, you can sell later at a higher price — or hold if you believe in the project.

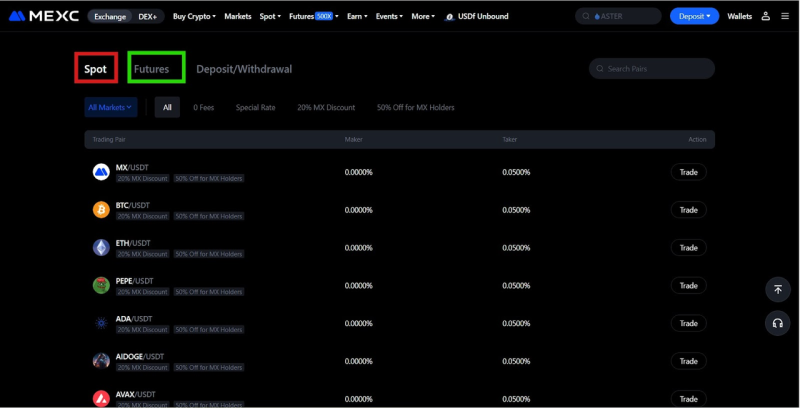

Here is what a basic trading interface looks like

This screenshot shows how “Spot” and “Futures” sections are separated on a crypto exchange interface. Each section displays its own trading pairs and transparent fee structure — for example, 0% maker and 0.05% taker fees for common pairs like BTC/USDT or ETH/USDT.

Common Mistakes Beginners Make

| Mistake | How to Fix It |

| Using market orders too often | Use limit orders for lower maker fees |

| Ignoring fee structures | Always check — some exchanges offer 0% maker fees |

| Overtrading | Stick to your plan, not emotions |

| Weak security | Always enable 2FA and verify withdrawals |

Why Start with $100?

Starting with $100 limits your risk while giving you a chance to learn the basics of crypto trading. With $100, you can experiment with strategies, place orders, and get comfortable with market fluctuations without significant financial stress.

How to Trade $100 Step-by-Step

Step 1: Set Up Your Account

Before you can start trading, you need to create an account. Here’s how:

- Sign Up: Visit MEXC’s website and sign up with your email or phone number.

- Verify Your Identity: Complete the Know Your Customer (KYC) process by submitting identification documents.

- Enable Two-Factor Authentication (2FA): Protect your account with 2FA for added security.

Step 2: Deposit Your $100

Once your account is set up, fund it with your initial $100:

- Deposit via Bank Transfer: Use your bank to transfer funds, depending on your region.

- Deposit via Cryptocurrency: If you own crypto, transfer it into your MEXC account.

Hint: Check for any fees that might apply during the deposit process.

Step 3: Choose the Right Trading Pair

Now that your account is funded, choose a trading pair, such as BTC/USDT or ETH/USDT. For beginners, stablecoins like USDT are ideal since they are pegged to the US dollar, reducing volatility.

Step 4: Understand the Types of Orders

- Market Orders: These execute immediately at the best available price but may involve higher taker fees.

- Limit Orders: Set the price at which you want to buy or sell. These orders may take longer but come with lower fees, especially maker fees.

Tip: Always use limit orders for better control over pricing and lower fees.

Step 5: Place Your First Trade

Here’s how to place your $100 trade:

- Select Trading Pair: For example, ETH/USDT.

- Choose Limit Order: Ensure you use a limit order for 0% maker fees. You could use various order types such as buy limits, sell limits, buy stops and sell stops.

- Enter Order Details: Decide how much Bitcoin you want to buy with your $100.

- Set Your Price: Set a price at which you're comfortable buying/selling (e.g., place a buy limit at $116,500 if Bitcoin is priced at $117,000 for a buy position).

- Confirm Your Order: Review and confirm your order.

Step 6: Monitor Your Trade

Check the status of your order. If it’s not filled yet, it remains "open." Monitor price fluctuations and adjust your order if necessary. For instance, the price might just drop to $116,700 before rising again beyond $117,000. This would mean you invalidate the buy limit set in the previous example.

Step 7: Close Your Trade

When your trade is filled and you’ve made your desired profit (or loss), you can close your position. If using a limit order, you can place a sell order to lock in profits.

What’s Next?

- Explore More Trades: Once comfortable with spot trading, you can begin exploring futures trading for more advanced strategies.

- Passive Income Opportunities: Consider staking or airdrops to earn passive rewards.

- Educational Resources: Learn more about crypto with MEXC’s tutorials and guides.

Conclusion

Placing your first $100 trade isn’t about getting rich — it’s about understanding how markets behave.

Once you’ve done it once, you’ll realize crypto isn’t magic; it’s just math, patience, and practice.

So start small. Learn fast. And remember — 0% maker fees and transparent structures always help your learning curve.

Editorial staff

Editorial staff

Editorial staff

Editorial staff