CoinsPaid vs NOWPayments: choosing a crypto payments partner for 2026

As we move into 2026, crypto payments are increasingly treated as another payment method. That shift changes the procurement conversation. The big question now is: “Which vendor will make it operationally boring?”

This article is a practical comparison of two well-known providers, CoinsPaid and NOWPayments, through the lens that matters during procurement and rollout.

A quick comparison

The most straightforward way to approach the comparison is to look at what both providers optimize for.

CoinsPaid is positioned as a business-grade, end-to-end crypto payments partner designed for companies that care about regulated-market readiness, predictable operations, and full-cycle support (from onboarding to settlement). CoinsPaid is EU-licensed and reports $28B+ processed since 2019.

NOWPayments positions itself as crypto-to-crypto payments infrastructure and a product with broad asset coverage. It’s registered as FD Transfers LLC under the laws of Saint Vincent and the Grenadines and reports $10B+ processed since 2019.

For an at-a-glance comparison, the table below maps CoinsPaid and NOWPayments against the criteria that typically drive procurement decisions and rollout planning.

| Criteria | CoinsPaid | NOWPayments |

| Volume processed since 2019 | $28B+ processed since 2019 | $10B+ processed since 2019 |

| Licensing | EU licensed | Offshore registration; license not required in jurisdiction |

| Registration footprint | Estonia, Lithuania, Canada, USA | Saint Vincent and the Grenadines |

| Independent security audits | Yearly third-party security audits | Not listed |

| Financial reporting | Comprehensive reporting for reconciliation | Internal procedures noted |

| Custody / asset control | Custodial wallet with regulated data storage | Non-custodial; for fiat conversion info goes via intermediary (Banxa) |

| Payment options | Invoicing, payment links, mass payouts, PoS (including SoftPOS) | Invoicing, mass payouts, SoftPOS |

| Treasury | Business wallet available | Not listed |

| OTC desk | Available | Not listed |

| PoS terminals | Provides terminals | Only SoftPOS |

| Supported currencies & fiat | 50+ crypto; auto conversion into 40+ fiat | 300+ crypto; 25 fiat via Banxa (extra KYC/KYB) |

| Pricing approach | Under 1.5% with volume-based reductions | Fixed: 0.5% mono, 1% conversion (+ network fees) |

| Support & comms | 24/7 email + secured support chat environment | 24/7 email, Telegram, website chat |

Getting started: onboarding, oversight, and fiat settlements

For most businesses, “getting started” with crypto payments boils down to three questions:

- What compliance posture do they show?

- Where is the counterparty registered, and will that complicate procurement or banking relationships?

- If we need fiat settlement, is it native or routed through a third party?

Licensing and onboarding expectations

CoinsPaid operates as an EU-licensed provider. For regulated markets, that typically comes with more structured onboarding and clearer expectations around verification and ongoing compliance.

NOWPayments is registered in Saint Vincent and the Grenadines, where licensing is not required, and states that monitoring is handled through internal procedures.

Legal entity and footprint

Where a provider is registered can shape contracting terms, internal risk comfort, and how a counterparty is perceived by other stakeholders (including banks).

- CoinsPaid: registration footprint listed across Estonia, Lithuania, Canada, USA

- NOWPayments: described as FD Transfers LLC under Saint Vincent and the Grenadines

Fiat withdrawals

Merchants may accept crypto, but they often want to settle in fiat for payroll, suppliers, taxes, and accounting simplicity.

- CoinsPaid: lists automatic conversion into 40+ fiat currencies

- NOWPayments: lists 25 fiat currencies via Banxa and notes additional KYC/KYB for fiat withdrawal through that intermediary

Why this matters: intermediary-based settlement adds another party to the chain. That can mean an extra onboarding track, more procedures, and more handoffs when exceptions happen. A more in-platform approach usually reduces coordination overhead and keeps settlement loops cleaner.

Integration

For most serious implementations, API integration is the default, especially for custom checkouts, marketplaces, and high-volume flows where payment status handling and reconciliation matter. Both CoinsPaid and NOWPayments support API-based integration.

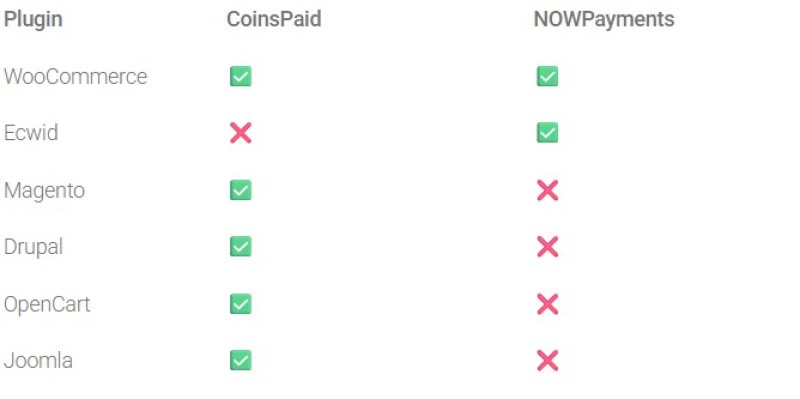

Where they split is in listed plugins, which can materially affect time-to-launch for platform-led merchants.

If you're building around an API, either provider can work. If you’re relying on a CMS plugin, the better fit is simply the one that supports your stack out of the box.

Supported currencies

NOWPayments lists 300+ cryptocurrencies, while CoinsPaid lists 50+.

A larger catalog is helpful when your customers genuinely demand long-tail tokens. But token breadth also increases operational surface area: more assets and networks to watch, more liquidity considerations, more reconciliation edge cases, and more “unusual” transactions that support teams have to explain.

Many businesses intentionally keep the supported set tight (major coins and stablecoins) because it covers most demand while keeping operations predictable.

Custody & control

Custody defines who holds assets, how access/approvals work, and what your treasury team can do the moment funds arrive. It also affects incident response and vendor risk.

CoinsPaid operates with a custodial wallet model and also offers a business wallet. For many companies with formal finance controls, custodial setups are attractive because wallet infrastructure and custody processes are handled within the provider’s environment. The merchant focuses on internal approvals, reconciliation, and settlement policies.

NOWPayments positions its core flow as non-custodial, with custody options depending on setup. Non-custodial designs often appeal to teams that want direct control over wallet ownership and routing, but they usually require the merchant to carry more of the wallet and security responsibility.

On top of that, NOWPayments’ crypto-to-fiat flow is commonly structured through an intermediary, which adds another party into the conversion and withdrawal chain.

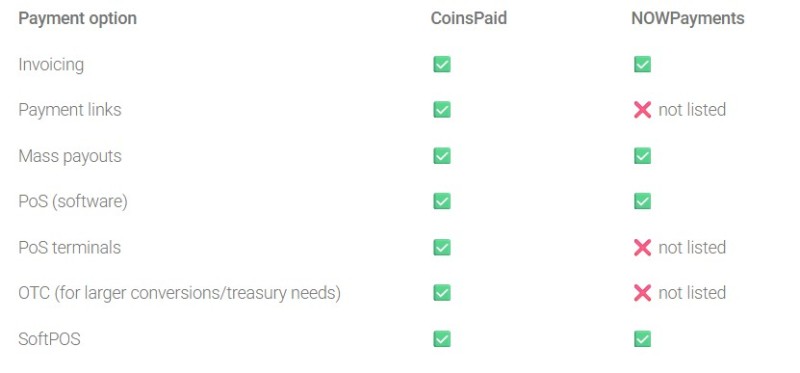

Payment methods

At the foundation, both platforms cover the basics most companies start with: invoicing, mass payouts, and POS software.

The differences show up in how many ways you can collect payments without engineering new flows.

CoinsPaid lists additional options like payment links, POS terminals, and an OTC desk (for larger conversions/treasury needs). NOWPayments lists core tools like invoicing, payouts, and SoftPOS, but does not list payment links, POS terminals, or an OTC desk.

Security & compliance

Security is easy to talk about and hard to verify, which is why procurement teams look for external checks.

CoinsPaid notes annual independent third-party security audits. These are useful as a due diligence artifact. Both platforms mention transaction monitoring and risk controls, and CoinsPaid also mentions internal practices like mandatory employee training.

NOWPayments similarly references monitoring and risk controls but indicates it does not hold public MSB/VASP licenses.

Merchant support

Once crypto is live, finance, support, compliance, and ops all need enough shared context to handle exceptions without escalation spirals.

CoinsPaid lists 24/7 support via email and a secured support chat environment, plus education resources (Academy and blog). NOWPayments lists 24/7 support via email, Telegram, and website chat.

So, if you expect sensitive, account-level troubleshooting and want a more controlled support environment (with training resources to align multiple teams) CoinsPaid is the stronger fit.

To sum it up

CoinsPaid and NOWPayments can both help you accept crypto.

CoinsPaid is positioned as an end-to-end merchant setup: regulatory posture, compliance workflows, wallet management, conversion, and fiat withdrawals are presented as part of the provider-managed stack. That can make crypto feel closer to a managed financial service, especially for teams that want predictable settlement and cleaner reporting.

NOWPayments enables crypto payments with broad asset coverage and a non-custodial core flow, but more operational, security, and governance responsibility tends to remain with the merchant. And because it doesn’t hold a formal license, that can become more sensitive as regulation tightens globally. In scenarios involving external constraints (network issues, third-party freezes, or intermediary limits), recovering funds or resolving exceptions may be more complex because fewer parts of the chain are provider-controlled.

So, if your goal is to make crypto payments operationally “boring”, CoinsPaid is the more straightforward fit.

Editorial staff

Editorial staff

Editorial staff

Editorial staff