This allure of "cheap coins" is powerful, but it’s often a trap. The most important rule in crypto — and the best way not to lose your money — is to understand that the price of a single coin means nothing without context. A cheap stock isn't always a bargain, and a cheap crypto isn't always the next Bitcoin.

In 2026, this question has resurfaced with renewed intensity. Why? Because Ripple (XRP) is having a massive year. With over $844 million flowing into new XRP ETFs in just the first quarter and the launch of Ripple's own stablecoin (RLUSD), the hype is back. But hype doesn't change math. Let's break down reality.

Bitcoin vs. XRP: The Fundamental Differences

To understand why XRP cryptocurrency will likely never be Bitcoin, you have to look under the hood. They aren't just different brands. They are fundamentally different machines built for different purposes:

● The Engine. Bitcoin runs on mining. It's energy-intensive and relies on miners to secure the network. This makes it incredibly secure and decentralized, but slow. Digital mining website is one way to solve it — faster than hardware mining minus the costs. XRP crypto, on the other hand, doesn't use mining. It uses the XRP Ledger Consensus Protocol, where a group of trusted "validators" agrees on transactions. This makes it incredibly fast and energy-efficient, but leads to debates about how decentralized it truly is.

● Speed & Cost. This is the biggest practical difference. A Bitcoin transaction can take 10 minutes to an hour and cost anywhere from $5 to over $50 during peak times. An XRP transaction settles in 3-5 seconds and costs fractions of a penny ($0.0002).

● Supply (The Inflation Factor). Bitcoin has a hard cap of 21 million coins, making it deflationary gold. XRP has a maximum supply of 100 billion coins, with a significant portion still held in escrow by Ripple, the company.

So, what is XRP crypto? It's a high-speed, low-cost bridge currency, not a scarce digital collectible.

| Feature | Bitcoin (BTC) | Ripple (XRP) |

| Transaction Speed | 10 - 60 Minutes | 3 - 5 Seconds |

| Transaction Cost | High ($5 - $50+) | Ultra-Low (~$0.0002) |

| Max Supply | 21 Million (Scarce) | 100 Billion (Abundant) |

| Primary Use Case | Store of Value (Digital Gold) | Global Payments (Bridge Currency) |

| Consensus Mechanism | Proof of Work (Mining) | XRPL Consensus (Validators) |

| Energy Usage | High (Nation-state level) | Minimal |

The "Job Description": Digital Gold vs. Global Payments

Bitcoin and XRP aren't competitors. They are colleagues in the digital finance world with very different job descriptions.

Bitcoin's Job: The Digital Vault

Bitcoin’s primary role is a Store of Value. Like gold in a vault, you don't need to move it quickly. You need it to be secure, unhackable, and scarce. Its slowness is a feature of its extreme security. Certain companies use XRP as their main asset, those are called XRT Treasuries — they release shares to the public and you can trade them with xm promo code.

XRP's Job: The Global Sprinter

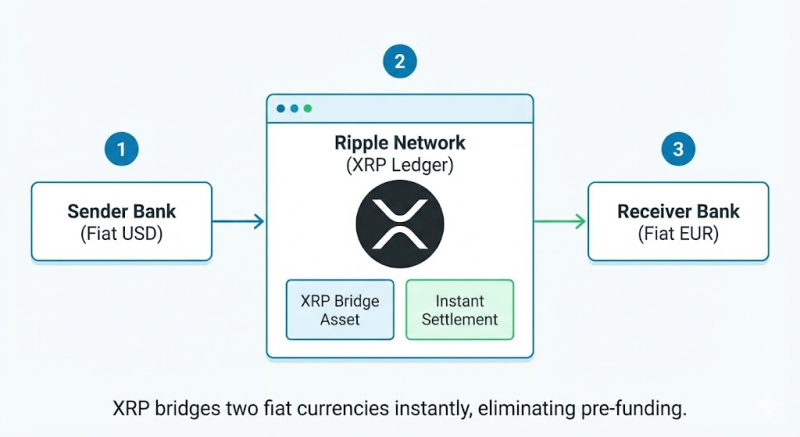

XRP's job is to be a liquidity provider for cross-border payments. The legacy banking system is slow and expensive. Ripple uses XRP to bridge two fiat currencies instantly. To do this, the XRP Ripple coin needs to be lightning-fast and practically free to send.

Think of it this way: Bitcoin is the gold bar you keep in a safe for 30 years. XRP is the Visa network that processes your coffee purchase in seconds.

Furthermore, the XRPL is evolving. With the introduction of sidechains and hooks, we are seeing the rise of XRP smart contracts, enabling decentralized finance applications atop its speedy network.

The Math: Why XRP Will Never Hit $100,000

This is the most critical section for protecting your capital. The belief that XRP could reach Bitcoin's price per coin is based on a misunderstanding of market capitalization.

The Golden Formula: Market Capitalization = Price Per Coin × Circulating Supply

Let’s do the math. If XRP reached Bitcoin’s current price of roughly $100,000 per coin:

- $100,000 (Price) × 55 Billion (Approx. Circulating Supply) = $5.5 Quadrillion Market Cap.

For context, the GDP of the entire world is around $100 trillion. For XRP to hit $100k, it would need to be worth 55 times more than the entire global economy. It is mathematically impossible under current global financial conditions.

The real question isn't "Can XRP hit Bitcoin's price?" but "Can XRP flip Bitcoin's market cap?" It's highly unlikely, as Bitcoin is the de facto standard for institutional saving, but it is at least theoretically possible if the entire global banking system adopted XRP.

Conclusion: Not the "Next Bitcoin," But Maybe Something Else?

So, can XRP crypto be the next Bitcoin? No. It was never designed to be.

Bitcoin is the undisputed king of storing value — digital gold. XRP is aiming to be the undisputed king of moving value — digital cash for banks. Trying to compare their price per coin is like comparing the price of a single share of Apple stock to the price of a single barrel of oil; they are totally different assets.

Don't lose money chasing a mathematical impossibility. Bitcoin is for saving, XRP is for spending and moving value. Both can succeed in the future financial ecosystem without one having to replace the other.

FAQ

1. Is XRP a meme coin?

No. While the XRP meme coin narrative sometimes pops up due to its passionate community, XRP is a utility token with a clear use case in enterprise payments and a decade of technological development.

2. Can XRP reach $1,000?

It is extremely improbable. At $1,000, XRP's market cap would be roughly $55 trillion, which is roughly double the GDP of the United States and four times the market cap of gold. While not mathematically impossible like $100k, it would require a complete restructuring of the global financial system.

3. What is the relationship between Ripple and XRP?

Ripple is a private technology company that builds payment solutions. XRP is an independent, open-source digital asset. Ripple uses XRP in its products (like On-Demand Liquidity), and it holds a large amount of XRP, but it does not "control" the XRP Ledger.

Editorial staff

Editorial staff

Editorial staff

Editorial staff