- Outline — What I’ll Cover

- Introduction — Why a Perpetuals DEX Like Aster Deserves Attention

- What Is Aster? A Short, Practical Definition

- Early Traction: Numbers That Matter

- Trading Features That Create Sticky Users

- Leverage: The Double‑Edged Sword

- Yield Mechanics — Earn While You Trade

- Tokenomics & Unlock Schedule — The Numbers That Move Markets

- Where to Buy & How Traders Will Interact (Non-Promotional)

- Security & Diversification — Practical Safety Steps

- Marketing, Onboarding, and Why Adoption Matters for Price

- ASTER Coin Price Prediction — Scenarios

- Concrete Points to Remember for Your ASTER Coin Price Prediction

- How Third‑Party Signals and Analysts Fit In

- Final Thoughts — Where I Stand

- FAQ — Frequently Asked Questions

- Closing — A Practical ASTER Coin Price Prediction Framework

Outline — What I’ll Cover

- What Aster is and why it matters

- Traction & key metrics that caught my eye

- Product features: perpetuals, hidden orders, leverage, USDF

- Tokenomics, unlock schedule and distribution

- Risks — leverage, token unlocks, centralization and governance

- Where Aster fits in the market and how it can grow

- My ASTER Coin Price Prediction and scenarios

- Practical takeaways and FAQs

Introduction — Why a Perpetuals DEX Like Aster Deserves Attention

Perpetuals decentralized exchanges are the most interesting corner of DeFi to me right now. I don’t tell people to recklessly trade huge leverage — far from it — but there’s a desperate demand from serious day traders for leverage levels the current on‑chain markets struggle to provide. Aster and its peer projects are addressing that gap. This is the backdrop to my ASTER Coin Price Prediction.

Aster launched recently and has already seen impressive early traction. It’s hard to ignore platforms that can attract billions in daily volume and large TVL in a matter of weeks. When you marry product-market fit (a real need for higher leverage in crypto) with an on-chain product that supports capital efficiency ( liquid staking tokens and yield-bearing stablecoins as collateral), you get a service that appeals to both retail and professional traders. That’s why I’m optimistic and why my ASTER Coin Price Prediction leans bullish. Some of the well-known crypto signal providers, including Bull Crypto Signals, have also shared a highly bullish outlook on Aster Coin, suggesting that its price could rise significantly in the coming weeks.

What Is Aster? A Short, Practical Definition

Aster is a perpetuals decentralized exchange (DEX) built to offer both perpetual and spot trading across multiple chains. Its core selling points are:

- MEV-free execution

- Simple mode with one‑click execution and a pro mode for experienced traders

- Support for many major chains (BNB, Ethereum, Arbitrum, Solana, and more)

- Hidden (invisible) limit orders so size and direction don’t show on the public book

- Grid trading, 24/7 stock perpetuals, and advanced order types

- Unique collateral mechanics that allow liquid staking tokens and yield-bearing stablecoins to be used, improving capital efficiency

At the center sits the ASTER token — a core asset for governance, rewards, participation, and protocol sustainability. That’s what makes ASTER both a utility and, for many traders, an opportunity asset. That centrality of the token is a big part of my ASTER Coin Price Prediction: token utility plus adoption equals value capture, provided tokenomics and distribution don’t kill the upside.

Early Traction: Numbers That Matter

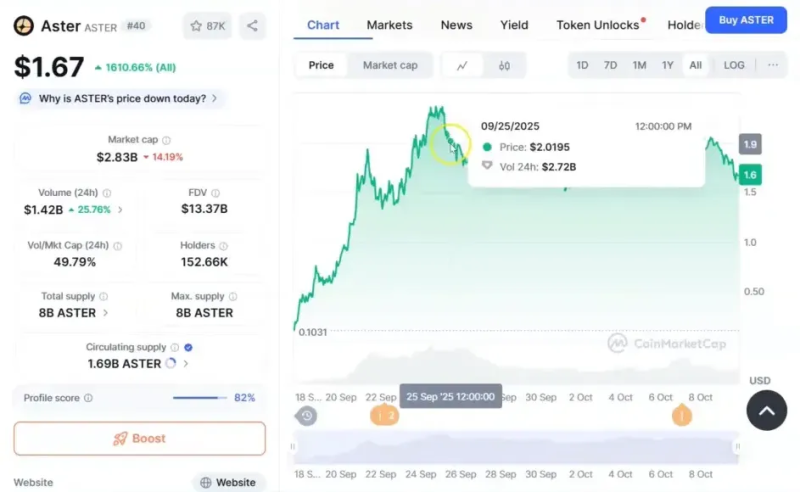

When judging an early project, numbers and user activity are the most convincing signals. Aster’s early figures were eye‑catching:

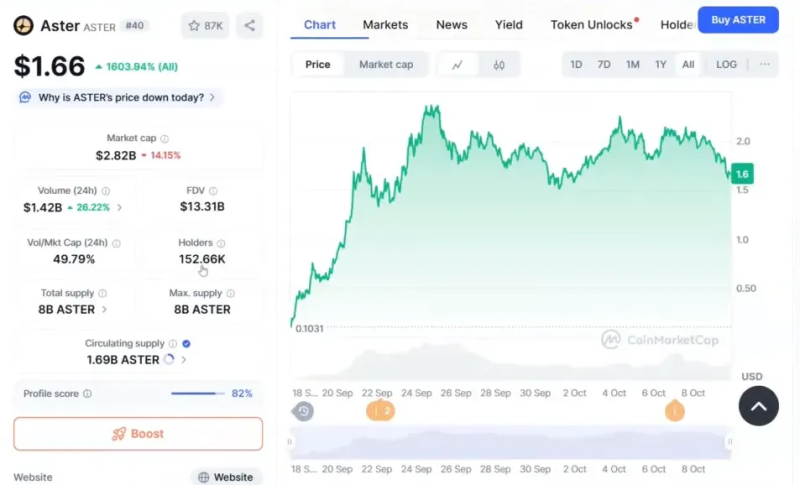

- Launched from about $0.10 and rose quickly (the launch price and early multiple are notable when projecting potential returns).

- Reported trading volume hitting around a billion dollars a day in the early window.

- Hundreds of thousands of holders — the video referenced roughly 152,000 holders in short order.

- Open interest reported near $4 billion and TVL around $1 billion.

- Over 100 tradable symbols within the platform.

Those numbers are not fluff. A billion a day in volume and multi‑billion open interest are signs the platform is being used, not just marketed. Active usage is a better predictor of sustainability than hype alone. From an ASTER Coin Price Prediction standpoint, such early product-market fit is the kind of data that moves the needle in favor of upside — but it’s not a guarantee.

Trading Features That Create Sticky Users

Here’s where Aster gets interesting for professional traders and heavy users. The platform offers features many margin traders crave:

- Hidden orders: place limit orders that remain invisible to the public order book so you’re not front‑run or gamed by other market participants.

- High leverage: the D‑Gen area reportedly offers up to 1000x leverage for those who want it (yes, you read that right). More conservative leverage options like 5x, 25x and 100x are available too.

- One‑click and pro modes for different trader skill levels, plus stop loss and take profit capabilities.

- Grid trading and continuous stock perpetuals — features that make the product a one‑stop shop for advanced traders.

For many skilled day traders, the ability to use high leverage, invisible orders, and cross‑chain access will be a primary draw. That’s exactly the group these platforms need to win if they want sustained volume and token utility. My ASTER Coin Price Prediction accounts for a plausible scenario where traders migrate to Aster from centralized venues because of its unique on‑chain features.

Leverage: The Double‑Edged Sword

Let me be blunt: high leverage is intoxicating and extremely dangerous to anyone who doesn’t know what they’re doing. I said this in the video, and I’ll say it again here: if you aren’t a seasoned futures or derivatives trader, don’t touch perpetuals or futures. I’ve seen traders make money on lucky early trades and then blow accounts because they overestimated their skill.

That said, the presence of high leverage drives volume — and volume drives liquidity, fees, and token utility. Aster’s ability to attract high‑frequency, high‑ticket traders could accelerate its growth and feed into a bullish ASTER Coin Price Prediction. It’s a balancing act: for the protocol, leverage is great; for the average user, it can be lethal.

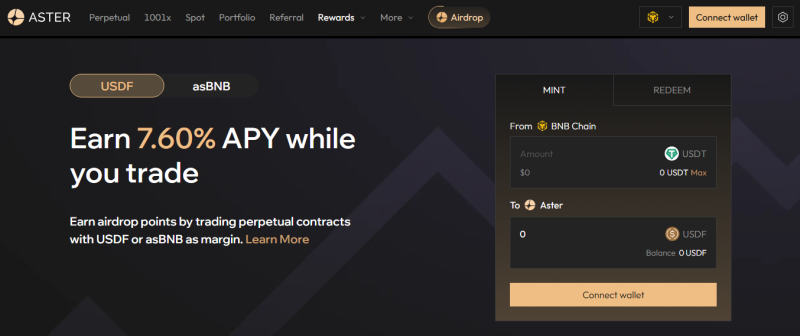

Yield Mechanics — Earn While You Trade

Aster introduces yield mechanisms that can be attractive to active users. One of the interesting features is the platform stablecoin (USDF in early docs) that’s yield-bearing. You can mint USDF, hold it, and earn yield if you remain active and meet minimum trading thresholds (the platform mentioned earning via activity — e.g., being active two days per week and trading over $2,000 per week to qualify for certain rewards).

The protocol also discussed earning airdrop points by trading perpetual contracts and minting/depositing USDF. Reported yields in certain earn strategies were in the range of ~7–10% depending on participation and strategy. From an ASTER Coin Price Prediction perspective, these yield mechanics increase stickiness and provide token demand via utility — people hold and use ASTER or USDF to participate in the ecosystem, which supports token price on the margin.

Tokenomics & Unlock Schedule — The Numbers That Move Markets

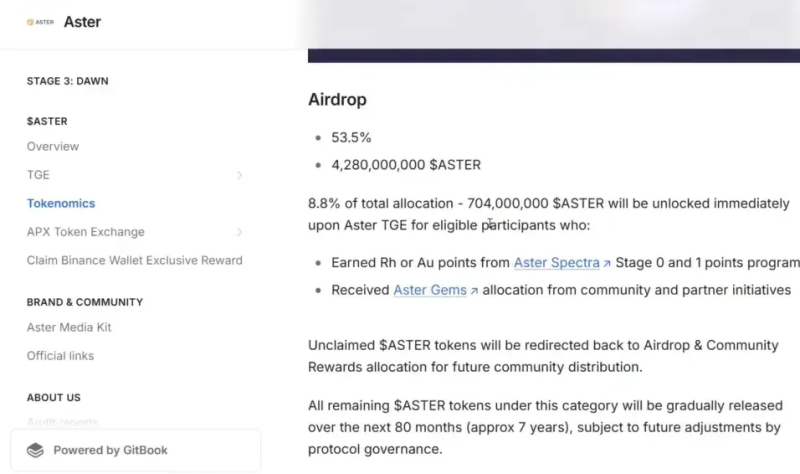

Token distribution and unlock schedules are critical when evaluating any project. The Aster tokenomics in the early materials showed a heavy focus on airdrops and scheduled unlocking:

- ~53.5% allocated to airdrop distribution.

- ~8.8% of total allocation unlocked immediately at launch.

- Subsets of airdrop allocations were scheduled to be gradually released over extended periods; early commentary noted a multi‑year release schedule — with some statements suggesting full distribution over roughly seven years.

- Remaining tokens vested across treasury, team, and other categories.

The key takeaway for my ASTER Coin Price Prediction is that while the total supply will eventually be fully released, the early unlocking pattern did not suggest a massive immediate sell pressure that would crush price within weeks. Spread out unlocks and vesting schedules reduce the risk of large dump events in the short run, particularly during a bull cycle where demand can outpace supply for months.

Where to Buy & How Traders Will Interact (Non-Promotional)

ASTER became available across centralized and decentralized venues. Centralized exchanges offer accessibility and simplicity for many buyers; decentralized perpetual platforms provide the native product experience. For futures traders, using the platform to access high leverage may be the primary pathway to exposure, while spot investors will typically acquire ASTER on major exchanges.

Note: I mentioned some exchanges and services in the video because they’re part of the on‑ramps and trading ecosystem, but here I’ll avoid promotional specifics and focus on strategy: if you plan to interact with ASTER or trade Aster perpetuals, diversify where you hold capital, manage counterparty exposure, and only use leverage if you know how to manage risk. If you’re inspired by these bullish predictions and want to explore new investment opportunities, you might also be interested in learning how to buy Jio Coin and other promising crypto assets. Jio Coin is also gaining attention among traders, with many experts believing it has the potential to deliver huge profits in the future as the project gains momentum.

Security & Diversification — Practical Safety Steps

History teaches us that exchanges and products can fail. Even successful projects face outages or hacks. If you’re using ASTER or any high leverage product, consider these practical rules:

- Don’t leave all capital on a single exchange. Spread funds across multiple platforms for redundancy.

- Use hardware wallets for long-term holdings and custody solutions where possible.

- Limit leverage to levels you can afford to lose during an adverse move.

- Monitor unlock schedules and treasury movement — token supply shocks matter.

These steps reduce single‑point risks and make your exposure to ASTER more manageable as you watch how the market and protocol evolve.

Marketing, Onboarding, and Why Adoption Matters for Price

Traction in the early weeks is one thing; long-term success depends on consistent onboarding. Aster’s product is obviously built to attract professional and retail traders who want margin and perpetuals on chain. But growth requires marketing and outreach — getting day traders to switch, getting traders comfortable with on‑chain derivatives, and convincing liquidity providers to keep capital in the protocol.

My ASTER Coin Price Prediction factors in the fact that if Aster can capture even a small percentage of traditional day traders migrating to crypto derivatives, the growth in trading volumes and fee revenue could be exponential. That in turn supports token utility — more fee rebates, more staking , more demand for ASTER as a governance/rewards asset.

ASTER Coin Price Prediction — Scenarios

Let’s map out three practical scenarios and what they mean for my ASTER Coin Price Prediction. I’ll keep this grounded in the facts: launch price (~$0.10), early multiples (up ~16x in early trading), and late‑stage speculative prices seen across bull cycles.

Base Case — Continued Growth and Moderate Token Appreciation

Assumptions:

- Platform continues to attract active traders and maintains >$500M daily volume.

- Token unlock schedule is gradual and does not cause large dumps.

- Yield and collateral mechanics increase stickiness, leading to stable TVL.

Under this case, ASTER appreciates as usage grows. Early holders benefit from network effects and utility-driven demand. ASTER Coin Price Prediction in this scenario is bullish but measured: a multiple on launch price that reflects utility capture rather than speculative mania.

Optimistic Case — Rapid Onboarding of Professional Traders

Assumptions:

- Major day traders migrate to Aster specifically for its high leverage and hidden order functionality.

- Liquidity deepens, TVL rises beyond early numbers, and the ecosystem launches new products.

- Token usage for fee discounts, staking, and governance increases materially.

If these things occur, ASTER could see significant upside. The ASTER Coin Price Prediction here is strongly bullish — multiples could outpace broader market growth, similar to some protocol leaders during previous cycles. Aster’s initial jump from ~$0.10 and the early 16x performance illustrates how quickly this can happen if product-market fit is real and adoption accelerates.

Bear Case — Unlock Pressure or Regulatory/Operational Issues

Assumptions:

- Large, concentrated token unlocks or team/treasury sells create downward pressure.

- Regulatory scrutiny on leveraged derivatives weakens adoption or forces product changes.

- Security or technical issues cause loss of confidence.

In this case, ASTER’s price falls back toward fair value for early-stage protocol tokens. My ASTER Coin Price Prediction in this scenario is cautious, with downside risk until issues are resolved and trust is rebuilt.

Concrete Points to Remember for Your ASTER Coin Price Prediction

- Launch price reference: Aster launched around $0.10. Early multiples reached ~16x in the short term — that’s real velocity.

- Volume matters: Aster reached impressive early daily volumes that support liquidity and token utility.

- Token unlocks appear scheduled over years — not front‑loaded dumps — which favors a more sustainable price path.

- High leverage and advanced features attract active traders; this is a tailwind for fees and token utility if onboarding continues.

- Yield mechanics like USDF minting and activity-based rewards create stickiness and a reason to hold on‑chain balances.

How Third‑Party Signals and Analysts Fit In

When you read ASTER Coin Price Prediction pieces across the web, you’ll encounter a variety of sources — from technical analysts to signal services. Similarly, Dark Crypto Signals has also expressed a strong bullish sentiment toward Aster Coin, predicting a potential price surge in the upcoming weeks. I mention them here because they represent different approaches: one more bullish and momentum-driven, the other often focused on risk and contrarian moves. Use third-party signals as inputs.. Combine them with on‑chain metrics, tokenomics, and product usage before forming your own ASTER Coin Price Prediction.

Final Thoughts — Where I Stand

Overall, I remain intrigued and bullish on Aster because:

- It solves a real problem for traders who want higher leverage and advanced order types on chain.

- Early adoption metrics are strong, suggesting product-market fit.

- Tokenomics and yield mechanics bolster the case for sustainable utility-driven demand.

That said, the usual caveats apply: high leverage products are risky for individual traders, token unlocks and treasury moves must be watched closely, and regulatory headwinds could change the landscape quickly. My ASTER Coin Price Prediction is bullish under realistic adoption scenarios, neutral-to-bearish under large unlock or regulatory stress scenarios. Manage risk accordingly.

FAQ — Frequently Asked Questions

What is Aster and how does it differ from other DEXs?

Aster is a perpetuals DEX that offers both spot and perpetual trading, MEV‑free execution, hidden orders, grid trading, and cross‑chain support. Its major differentiator is the focus on capital efficiency by allowing liquid staking tokens and yield-bearing stablecoins as collateral, and a product suite designed to attract professional margin traders.

How much can ASTER rise — what’s your ASTER Coin Price Prediction?

Price targets depend on adoption, volume, and tokenomics. In a base case with steady growth and adoption, ASTER could appreciate significantly from launch prices. In an optimistic case tied to rapid migration of high-volume day traders, the upside could be much larger — though this comes with risk. Conversely, large token unlocks or regulatory issues could push price down. Always model multiple scenarios before deciding.

Is it safe to trade with high leverage on Aster?

High leverage is inherently risky. If you aren’t experienced in futures and risk management, don’t trade high leverage. For seasoned traders, Aster’s feature set may be attractive, but prudent risk limits, position sizing, and stop loss rules are essential.

What do the tokenomics look like and will token unlocks affect price?

Early materials show ~53.5% allocated to airdrops, with ~8.8% unlocked immediately and staged releases over an extended schedule (discussions suggested a multi‑year distribution). That staggered release reduces immediate dump risk, but you should monitor the exact schedule and any changes to vesting that could affect supply dynamics.

How can I keep updated on Aster developments?

Follow official Aster channels, read the protocol docs, and watch on‑chain metrics (volume, TVL, open interest). Cross‑reference with independent commentary and services like Bull Crypto Signals and Dark Crypto Signals as additional inputs, but always verify with primary sources.

Should I keep ASTER on a single exchange?

No. Don’t keep all capital on one exchange. Spread funds across multiple platforms and use non‑custodial wallets for long-term holdings to mitigate exchange failures or outages.

Closing — A Practical ASTER Coin Price Prediction Framework

To recap: my ASTER Coin Price Prediction leans bullish because the product solves a real trader problem, early metrics are strong, and token utility looks deliberate. However, risk is real: leverage, unlock schedules, market sentiment, and regulation can swing outcomes. Treat any ASTER exposure with the same discipline you’d apply to risky derivatives: limit position sizes, diversify custody, and keep an eye on unlocks and on‑chain activity.

Finally, use all available data points — user activity, TVL, open interest, and product updates — to update your ASTER Coin Price Prediction over time. And if you’re looking at signal services, treat them as inputs: Bull Crypto Signals and Dark Crypto Signals can add perspective, but your own due diligence should be the deciding factor.

Editorial staff

Editorial staff

Editorial staff

Editorial staff