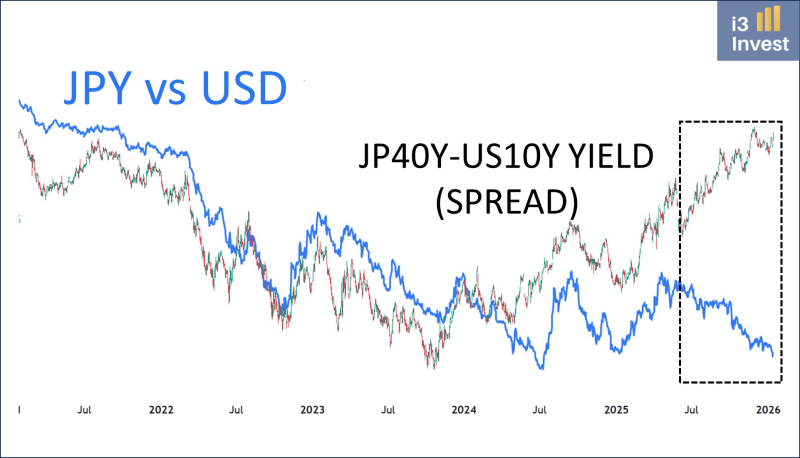

⬤ There's a weird thing happening in Japanese markets right now. The JP 40Y yield spread versus U.S. 10Y has been climbing aggressively over recent months, but the yen? It's just sitting there. Historically, when Japan's long-term bond yields rise like this, the yen should strengthen. That's not happening, and it's got people scratching their heads.

⬤ The JP 40Y has been moving like a meme stock—big, fast, erratic swings. Yet JPY/USD barely reacts. You'd expect the currency to track these bond market moves, but instead we're seeing a total disconnect. It's like watching two dancers completely ignore each other's rhythm.

⬤ This gap between bond yields and currency performance suggests something's off in the pricing mechanism. Either the bond market's running ahead of itself, or the currency market's missing something important. Whatever it is, this kind of divergence doesn't usually last forever—something's gotta give.

⬤ What makes this particularly interesting is what it might signal about broader market dynamics. If this divergence keeps widening, we could see sudden volatility when the realignment finally happens. Traders watching both the JP 40Y and JPY/USD know that when markets get this out of sync, the snap-back can be dramatic. The question isn't if they'll converge—it's when, and which one moves to close the gap.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah