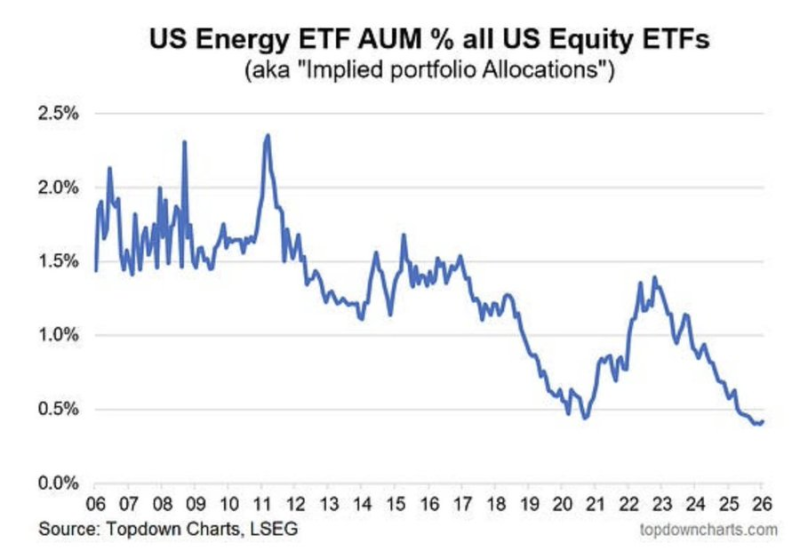

⬤ Energy stocks have basically fallen off investors' radar. The share of money going into energy ETFs like the Energy Select Sector SPDR Fund (XLE) has crashed to record lows—we're talking about allocations that are three to four times smaller than they were during the last big bull market. It's a massive shift in how people are building their portfolios.

⬤ The numbers tell the story pretty clearly. U.S. energy ETF assets as a slice of total equity ETF money have dropped from over 2 percent back in the mid-2000s to around 0.5 percent now. That's roughly an 84 percent nosedive in relative terms. And this is happening even though oil still powers most of what we do—cars, factories, you name it. Right now, U.S. shale drillers are struggling to make money at current prices, which means new supply isn't exactly flooding the market.

⬤ Here's where things get interesting: oil prices are sitting near recent lows, but oil company stocks are trading close to where they were in 2022. That's not normal. "The strength in oil equities implies expectations of tighter supply conditions, improved pricing power, or higher future cash flows for producers," suggesting that stock investors might be seeing something the oil market hasn't priced in yet—maybe tighter supplies down the road or better profits coming for energy companies.

⬤ This whole situation matters because energy drives inflation, keeps factories running, and basically keeps the economy moving. When energy ETFs are this underweighted compared to how important the sector actually is, you've got a mismatch. If oil prices start climbing from here, that gap between where investors are positioned and where things are actually heading could close fast—and when it does, energy stocks could make some pretty big moves.

Peter Smith

Peter Smith

Peter Smith

Peter Smith