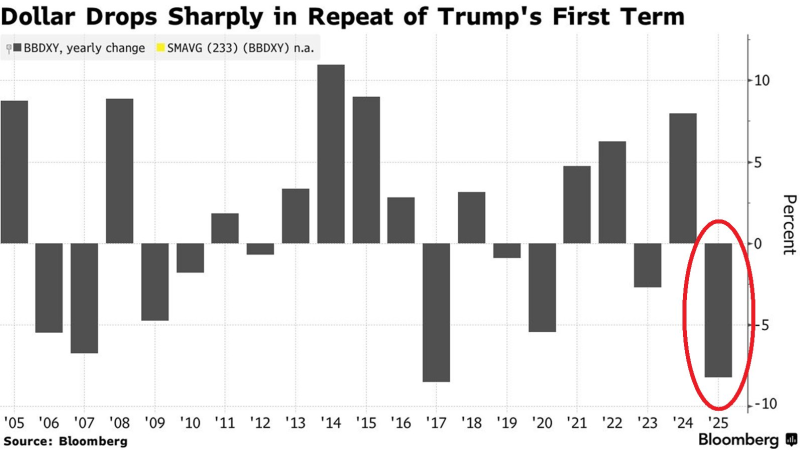

⬤ The greenback is getting hammered this year in what's shaping up to be one of its worst performances in recent memory. The Bloomberg Dollar Spot Index has tanked more than 8% so far, making it the biggest yearly drop since 2017 and only the second time it's fallen this hard in at least two decades. Meanwhile, the US Dollar Index (DXY) has cratered 9.8% over the same stretch.

⬤ After riding high for several years, the dollar's momentum has completely flipped. The Bloomberg Dollar Spot Index, which measures how the buck stacks up against a wide range of global currencies, shows a reversal that rivals the deepest slides we've seen in 20 years. The charts tell the story pretty clearly—this isn't just a minor pullback.

⬤ What makes this decline particularly notable is how broad-based it is. We're not talking about weakness against just one or two currencies—both major dollar indexes are down sharply, pointing to a widespread move away from USD positions. Money is flowing out of American assets at a pace we haven't seen in years.

⬤ Here's why it matters: when the dollar weakens this much, it ripples through everything from international trade to global investment flows. A softer greenback can make life easier for foreign borrowers and boost competitiveness abroad, but it also chips away at American purchasing power overseas. With both key indexes recording multi-decade lows, we're watching a real shift in how investors are thinking about risk and where they're parking their money.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah