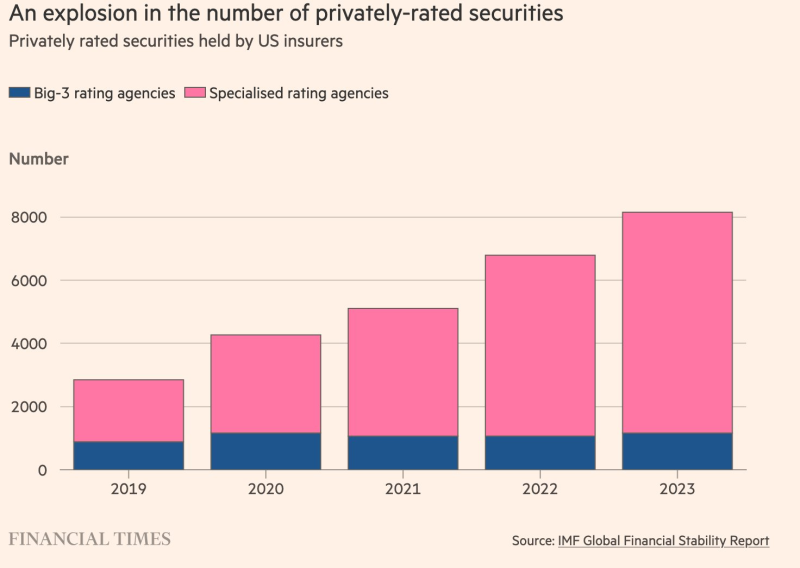

⬤ US insurance companies have dramatically increased their holdings of privately rated securities over the past few years. The numbers tell a striking story: from around 2,800 securities in 2019 to more than 8,000 by 2023. What's particularly interesting is that most of this jump came from specialized rating agencies rather than the traditional Big-3 firms. According to @HedgieMarkets, insurers are turning to these smaller agencies to get their private credit investments classified as investment grade.

⬤ The IMF Global Financial Stability Report data reveals something significant about how these ratings work. While the Big-3 agencies kept their numbers relatively steady, specialized firms picked up the slack. Here's why insurers are doing this: when the National Association of Insurance Commissioners assessed these same holdings, they often came back with lower risk grades. So insurers started shopping around for better ratings.

⬤ The numbers get even more interesting when you look at what happened in 2023. When securities switched from NAIC ratings to private letter ratings, about 80 percent got upgrades while only 4 percent were downgraded. The biggest jumps—six notches or more—all came from smaller firms. Take Egan-Jones, for example: this Philadelphia-based agency with roughly 20 analysts somehow rated more than 3,000 private credit deals in a single year. Meanwhile, Global Atlantic (owned by KKR) now has about a quarter of its $100 billion bond portfolio carrying these private letter ratings.

⬤ This whole situation matters because higher credit ratings mean insurers can hold less capital against their investments. That lets them operate with more leverage, which is great when things are going well but creates real risk if asset quality starts to slip. With life insurers sitting on an estimated $1 trillion in private credit, the growing gap between what regulators say and what private raters say represents a potential vulnerability if defaults start climbing or credit conditions tighten.

Usman Salis

Usman Salis

Usman Salis

Usman Salis