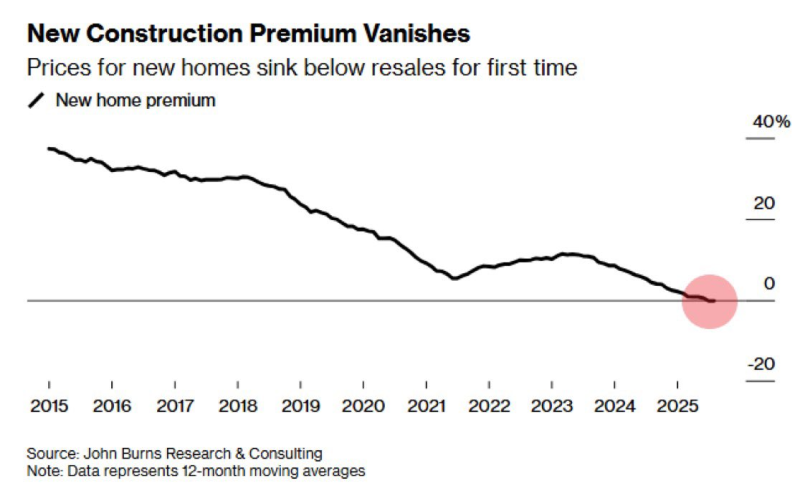

⬤ The U.S. housing market just hit a historic turning point. New data shows that prices for freshly built homes have dropped below resale home prices for the first time. The long-standing premium that new homes used to command has completely disappeared and actually gone negative, flipping decades of market tradition on its head.

⬤ The numbers tell a pretty clear story. The new-home premium has been sliding downhill for almost ten years now, but things really picked up speed between 2022 and 2025. What's driving this? A mix of affordability issues, construction costs that won't quit, and buyers who are just tapping out on higher-priced new builds. That premium, which used to sit comfortably above zero, tanked into negative territory in 2025, meaning resale homes are now actually pricier than brand-new construction.

The long-standing new-home premium has now turned negative, marking a historic reversal in a market where new builds traditionally command higher prices.

⬤ Here's what's really going on: mortgage rates are still elevated, and buyers are hunting for cheaper options. Builders have had to get aggressive with incentives—rate buydowns, straight-up price cuts, whatever it takes to keep sales moving. The data shows this downward slide started back in 2015 and really accelerated after 2021 when affordability became a major headache. With new homes now undercutting resales, it's clear how dramatically buyer preferences have shifted and how hard builders are working to match what people can actually afford.

⬤ Because it signals a major rebalancing in U.S. housing. This flip could shake up construction activity, mess with resale valuations, and change how buyers make decisions in the months ahead. Affordability is running the show now, and this shift proves the housing market is being shaped more by what people can actually pay than by any shortage of inventory. It could have real implications for price stability across both new and existing homes going forward.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi