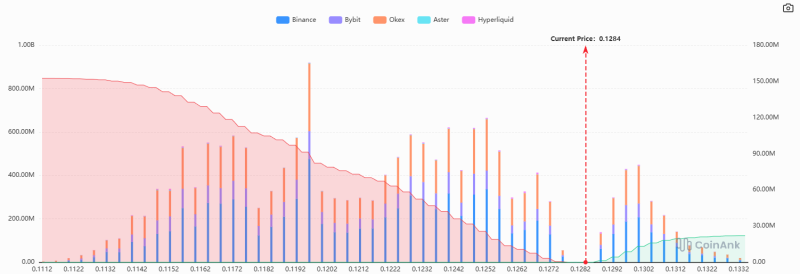

⬤ Dogecoin futures currently show a massive imbalance in trader positioning. Long positions sit around $850 million while shorts barely reach $22 million—a gap that shows most futures traders expect DOGE to climb higher. Recent data captured DOGE trading near $0.1284, with order books showing concentrated liquidity around that level.

⬤ Trading volume spreads across major platforms including Binance, Bybit, OKX, Aster, and Hyperliquid. The charts reveal how buy and sell orders stack up between $0.12 and $0.13, giving a snapshot of where traders are placing their bets. While the data doesn't pinpoint individual entry strategies, the sheer size of long exposure tells the story—futures traders are betting big on upside.

⬤ This kind of lopsided positioning carries weight in crypto derivatives. When longs dominate by this margin, the market can rocket higher if bullish momentum holds. But it's a double-edged sword—if sentiment flips or funding rates squeeze, those same leveraged positions can unwind fast and send prices tumbling.

⬤ DOGE remains one of the most actively traded altcoins in futures markets, meaning positioning shifts can move prices quickly once volatility picks up. With futures traders leaning this heavily long, attention now turns to how price action develops around the $0.1284 mark and whether this bullish setup holds as broader crypto market conditions evolve.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah