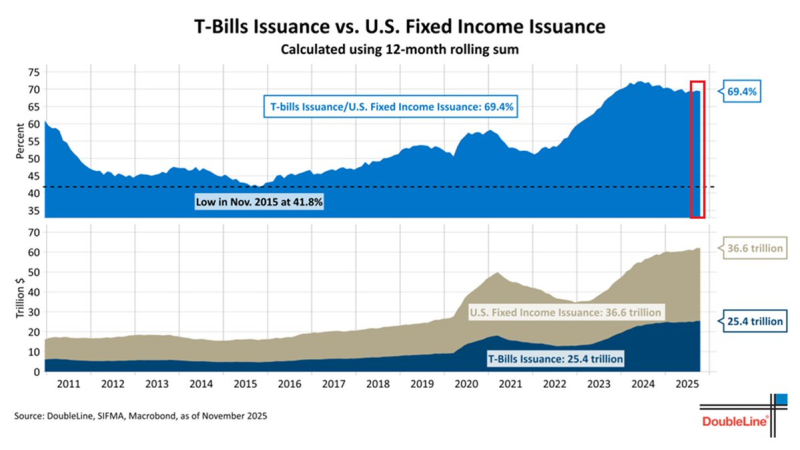

⬤ The United States has moved into a perilous new stage of its debt crisis. In the past year the Treasury sold twenty five point four trillion dollars of T-Bills, a record. Total fixed income issuance reached thirty six point six trillion dollars. T-Bills now form sixty nine point four per cent of all Treasury debt, close to the historical peak and far above the forty one point eight per cent low of November 2015.

⬤ The figures speak plainly. From 2023 onward the T-Bill share has risen steeply while total fixed income issuance has grown fast. Overall issuance stands at thirty six point six trillion dollars - T-Bill issuance alone has reached twenty five point four trillion dollars. The T-Bill share has advanced more than twenty seven percentage points since 2015, a basic change in how the federal government funds itself. The nation now depends on debt that matures within weeks or months - the refinancing window has shortened sharply.

Federal interest expenses now move almost in lockstep with the Federal Reserve's policy rate.

⬤ Because the government relies so much on short term debt, Fed policy and borrowing costs are linked directly. T-Bills mature within days to a year - any rate rise feeds straight into the cost of new debt. If inflation re-emerges plus the Fed lifts rates, interest expenses could reach unprecedented levels, given the large stock of existing debt.

⬤ The structure of government borrowing shapes both market stability and long-term fiscal health. Heavy use of T-Bills leaves the United States vulnerable to abrupt rate shocks and clouds the outlook for future funding needs. With issuance already at record levels, short term financing will stay a central problem for U.S. fiscal policy but also for global markets in the months ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis