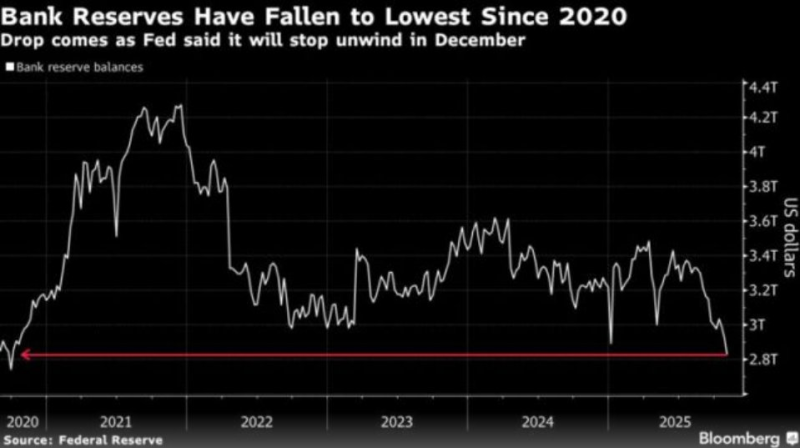

● According to recent data from Barchart (citing Federal Reserve and Bloomberg sources), U.S. bank reserves have fallen to $2.8 trillion—a level not seen since 2020. The decline signals growing pressure on liquidity as the Federal Reserve prepares to end its balance sheet drawdown this December.

● The drop comes after months of quantitative tightening (QT), where the Fed has been letting Treasury bonds and mortgage-backed securities roll off its balance sheet. While QT was meant to cool inflation and normalize the financial system after pandemic-era stimulus, it's also been steadily draining cash from banks.

● With reserves now approaching pre-2020 crisis levels, some analysts are worried about potential funding stress—especially for smaller banks. The situation echoes concerns from the 2019 repo market disruption, when overnight borrowing costs suddenly spiked due to a shortage of reserves.

● The Fed's decision to halt QT in December may be a preventive move to avoid triggering similar instability. Lower reserves typically mean tighter credit conditions, higher money market rates, and less room for banks to lend.

● Bloomberg's chart data shows reserves have essentially returned to pre-pandemic levels, marking a clear shift in monetary policy. How smoothly the banking system handles this tighter liquidity environment will depend heavily on the Fed's next steps.

Peter Smith

Peter Smith

Peter Smith

Peter Smith