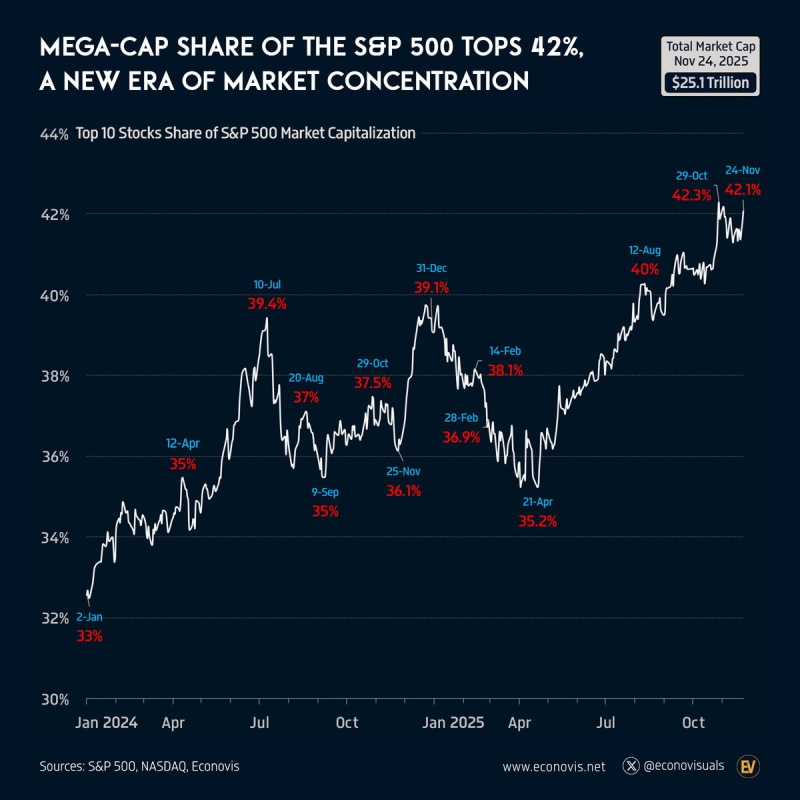

⬤ The S&P 500 grows more top heavy because the largest U.S. companies claim a larger slice of the market. On 24 November 2025 the ten biggest stocks represent 42.1 percent of the index's total value, almost equal to the October high of 42.3 percent. In January 2024 the same ten names held only 33 percent.

⬤ The figures show a straight rise through 2024 and 2025. The mega cap weight reached 35 percent in April 2024, passed 39 percent by midsummer and ended 2024 at 39.1 percent. Brief drops to 35 percent in September 2024 plus to 35.2 percent in April 2025 were met with immediate buying. After August 2025 the share stayed above 40 percent.

⬤ The chief engine is the group of tech besides AI-linked companies that keep beating the broader field. With the S&P 500 valued at $25.1 trillion, the ten giants dictate each small move in the index. Their quarterly profits, fund flows and investor mood now shift the whole market.

⬤ This shift rewrites the rules. When ten companies set more than 40 percent of the index's price, the market reacts sharply to news about those names alone. A wide gap has opened between the mega-caps and the rest of the market but also the gap keeps widening.

Peter Smith

Peter Smith

Peter Smith

Peter Smith