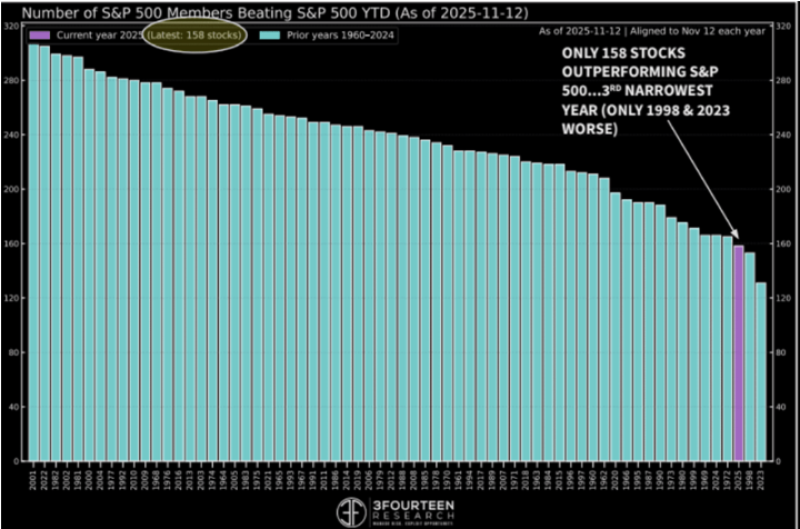

⬤ Fresh analysis from 3Fourteen Research reveals that as of November 12, only 158 companies in the S&P 500 are actually beating the index itself. That puts 2025 on track to be the third-narrowest year for market breadth since 1960, trailing only 1998 and 2023.

⬤ In most years, somewhere between 200 and 300 stocks manage to outpace the broader index by mid-November. This year's number sits well below that historical range. The gains we're seeing are coming from an incredibly small group of mega-cap tech companies, particularly those riding the AI wave like NVDA. While these leaders keep pushing higher, the rest of the market is essentially treading water.

The current concentration places 2025 among the tightest years for stock outperformance we've seen in more than six decades.

⬤ What we're watching is a growing divide within the index. Traditional sectors are either flat or struggling, while AI-focused names continue their run. The chart from 3Fourteen Research makes it clear just how unusual this level of concentration really is compared to the past several decades.

⬤ Why does this matter? When the entire market's performance hangs on just a few dominant players, everything becomes more fragile. A single earnings miss or guidance cut from NVDA or similar AI leaders can send ripples across the whole index. Right now, understanding where these AI stocks are headed is basically the same as understanding where the market's headed. That concentration creates opportunity, but it also means more volatility is baked into the system.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi