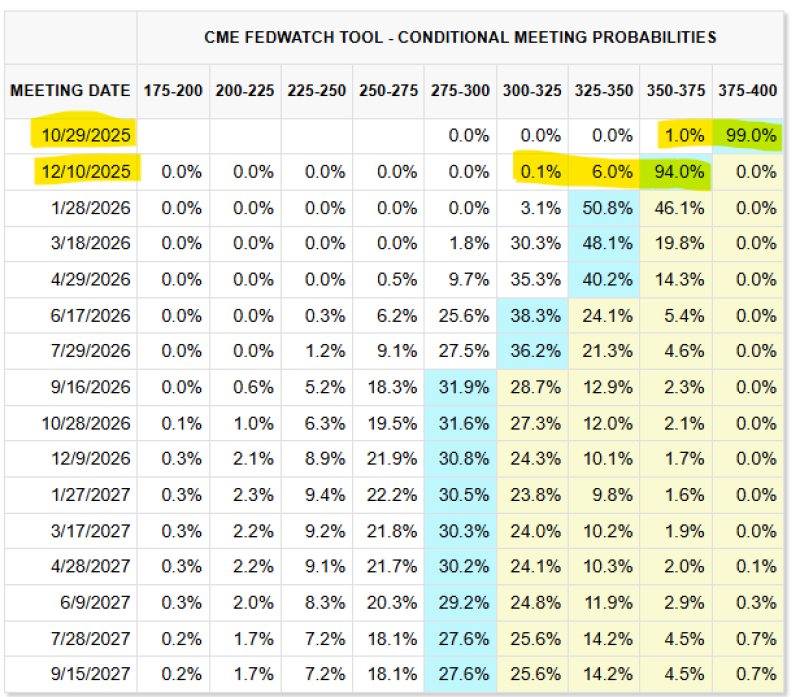

● As Stock Sharks pointed out, the bond market has fully priced in two Fed rate cuts before 2025 ends. The CME FedWatch Tool shows 99–100% probability the Fed will lower rates at its October 29 and December 10 meetings, pushing the Fed Funds Rate down to the 3.50–3.75% range.

● This shift reflects growing confidence that inflation is moving toward the Fed's 2% target, making room for easier monetary policy after more than two years of aggressive tightening. But there are trade-offs. Cutting too early while inflation lingers could reignite price pressures and weaken the dollar. Waiting too long risks choking growth and potentially triggering a sharper economic slowdown in 2026.

● Two rate cuts would ripple through markets. Lower borrowing costs should help corporate profits and pull more capital into growth sectors like tech, housing, and consumer credit. Fixed-income yields would drop, making bonds less attractive while boosting equity valuations. The catch? If inflation stays stubborn, the Fed might have to pause its easing — or even start hiking again in early 2026. That would blindside bond markets betting on a dovish path.

● What makes this moment notable is the context: we're potentially watching the end of the most aggressive rate-hiking cycle in decades. Since early 2022, the Fed cranked rates up by over 500 basis points to fight post-pandemic inflation. Now, with economic growth cooling and labor markets softening, investors are treating 2025 as the pivot point back toward normal policy. Whether that bet pays off depends on how inflation behaves in the final stretch of the year.

Usman Salis

Usman Salis

Usman Salis

Usman Salis