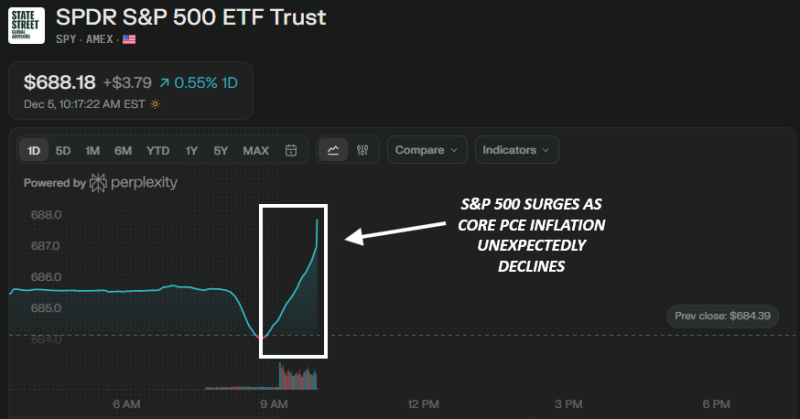

⬤ The SPDR S&P 500 ETF Trust (SPY) surged after new data showed Core PCE inflation fell to 2.8 %. The S&P 500 moved to within 30 points of a new record high. SPY left its flat morning pattern as soon as the inflation number appeared.

⬤ The climb ends a strong run for stocks. The S&P 500 has added $3.3 trillion in market value since its November 21 low besides SPY follows the same path. The chart shows a sharp rise after the lower inflation figure, as easing price pressure and steadier macro conditions push key sectors higher.

The instant rise in SPY shows how quickly equity markets react to inflation news.

⬤ The fall in Core PCE matters because it tracks underlying price stability and shapes views on future Fed policy. The fast move from a tight range to a strong advance shows renewed belief that current market conditions will last.

⬤ Why it matters - steady inflation decline lifts broad sentiment plus lowers near term uncertainty. With SPY near all time highs, the next economic releases will decide the next step. This latest print strengthens the view that financial conditions are improving and that the rebound in major equity benchmarks will continue.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova