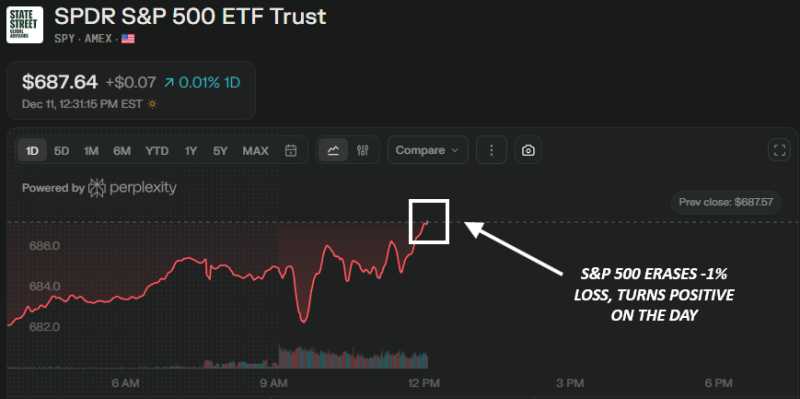

⬤ The SPDR S&P 500 ETF Trust (SPY) staged a clear midday rebound moving from negative to positive territory after an overnight slide of roughly one percent. Buyers entered on the decline and lifted the price back above the session's opening level - the shift demonstrated how fast momentum turns once demand reappears.

⬤ SPY rose from about 682 dollars to 687 dollars by early afternoon, a move that showed sentiment had changed as the hours passed. The recovery followed multiple sharp swings inside the day - buyers slowly gained the upper hand and wiped out the morning's losses.

Dip buyers were active while the market gave back losses, which allowed an even climb back.

⬤ The rebound repeats a common theme - buyers emerge on pullbacks plus convert early weakness into opportunity. SPY's return toward 687 dollars shows that demand remains firm even after a sharp morning drop that had traders second guessing the outlook.

⬤ A same day reversal of this sort carries weight because it proves the market can swallow volatility and recover its balance without delay. When an index claws its way back from a sizeable fall, confidence rises and traders adjust their risk stance for the remainder of the session.

Usman Salis

Usman Salis

Usman Salis

Usman Salis