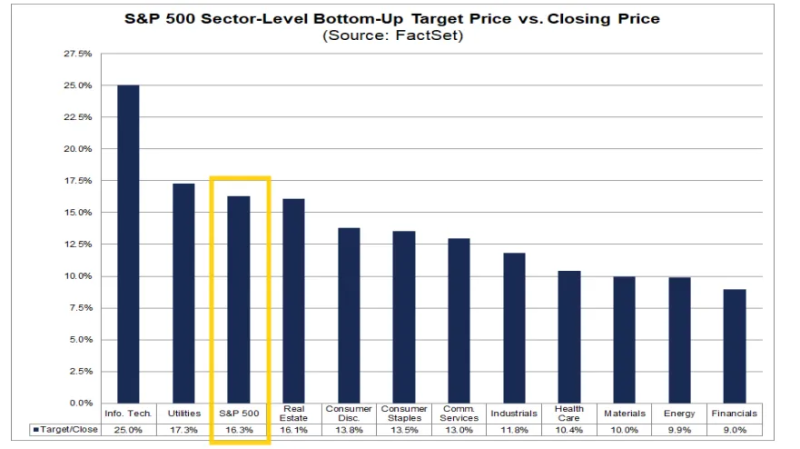

⬤ S&P 500 price targets just won't stop climbing. Bottom-up analyst estimates have now risen for 30 straight weeks, hitting a fresh all-time high of 8,085 for the next 12 months. That's about 16.3% upside from Thursday's close. The target's jumped 74 points in just the past week, 564 points over 10 weeks, and a massive 1,439 points since this streak began 30 weeks ago.

⬤ Information Technology's clearly the star here, with analysts projecting around 25% upside—the biggest expected gain across all S&P 500 sectors. Utilities come in second with roughly 17% potential upside, just ahead of the S&P 500's overall 16.3%. Real Estate's close behind at 16.1%, while Consumer Discretionary, Consumer Staples, and Communication Services are all looking at gains in the low-to-mid teens.

⬤ The more conservative projections tell an interesting story too. Industrials are expected to climb about 11.8%, while Health Care, Materials, and Energy are hovering around 10% upside. Financials rank last with just 9% expected gains. What's striking is the wide gap between sectors—analysts clearly favor growth-oriented plays like tech over cyclical and rate-sensitive areas.

⬤ Here's what matters: these rising targets reflect real optimism even with the market trading near record highs. Thirty consecutive weeks of upgrades isn't random—it shows analysts believe in sustained earnings growth, particularly in technology. But the sector-by-sector differences reveal something important: this isn't blind optimism across the board. Investors are being selective about where they see the real opportunities in 2025.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi