Ryan Detrick, a chief market strategist and a senior Vice President of LPL Finance, reports an interesting historical trend.

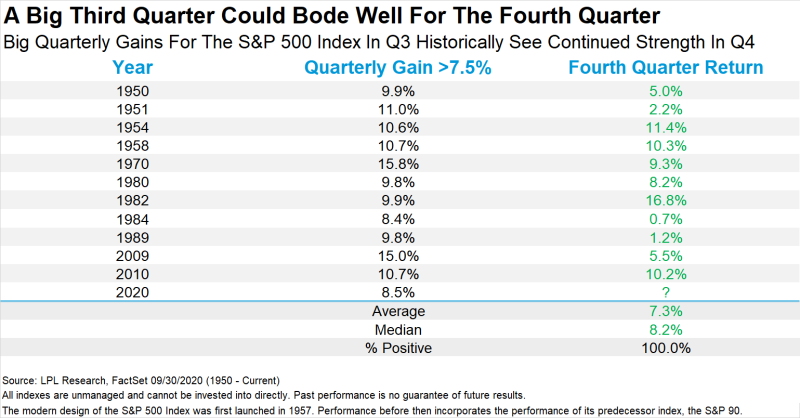

If the Q3 Is Strong, Q4 Will Also Rock

According to Mr. Detrick's observation, if the traditionally weak third quarter showed significant growth above 7.5%, then in all observed cases the growth continued in the fourth quarter. With an average growth rate of 7.3% in Q4, the last time a return was over 10%, 10 years ago.

"What happens to the S&P 500 when the usually weak Q3 is up a lot (>7.5%)? Well, Q4 has gained every single time, up 11 for 11, with an average return of 7.3%." Ryan Detrick via Twitter

The Best Q3 Results for the Last 10 Years

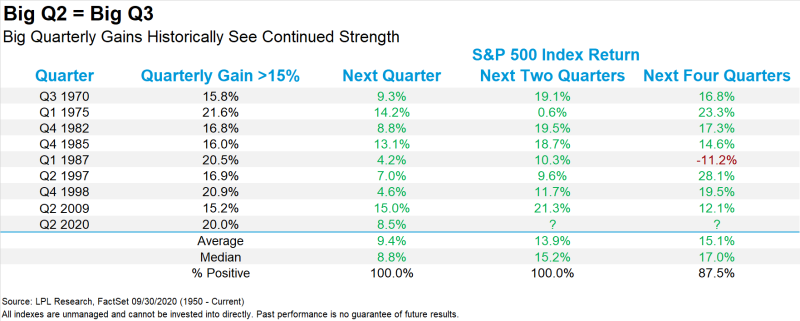

Perhaps this year this will also happen again, because, according to another fact from Mr. Detrick, the Q3 return this year is 8.5%, which is the best indicator since the 2010.

"The S&P 500 gained 20% in Q2, we noted at the time that strong gains the next quarter were quite likely. Played out once again, with a solid gain of 8.5% for the best Q3 since 2010." Ryan Detrick via Twitter

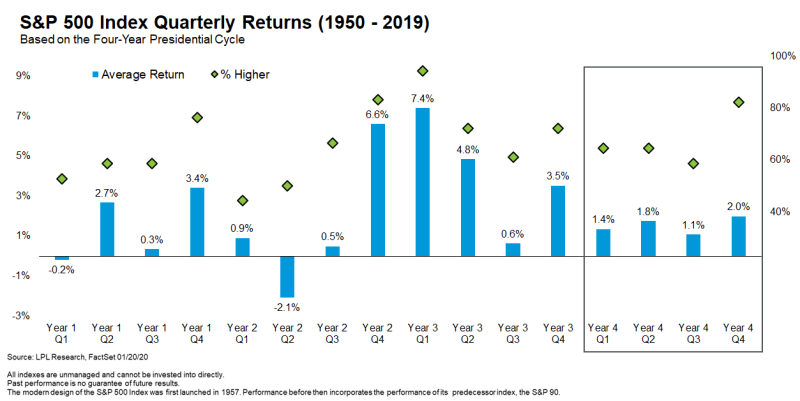

S&P 500 Performs Better in the 4th Year of the Presidential Cycle

Besides, this year is also an election year, which, as it turns out, also has a positive effect on the market. According to historical data, in the fourth year of the presidential cycle, the S&P 500 shows significant positive dynamics in the 4th quarter, in 82% of cases overtaking returns of other years.

"Breaking things down by the 4-year Presidential cycle shows the S&P 500 during Q4 of an election year is higher 82.4% of the time, one of the most likely quarters to be higher." Ryan Detrick via Twitter

If this historical trend continues this year, then investors will face a turbulent last quarter of the year, which began just today.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov