⬤ Goldman Sachs is sounding the alarm on a wave of mechanical selling that could hammer markets even if stocks climb higher. The investment bank expects systematic funds to be net sellers this week whether the market goes down, stays flat, or moves up—a rare configuration that shows how positioning imbalances can dictate short-term price swings.

⬤ The numbers tell a concerning story. If stocks drop again, Goldman estimates roughly $33B in forced selling could hit the tape. Break below 6,707 on the S&P 500, and that figure balloons to $80B over the next month. Even if markets stay completely flat, trend-following CTAs are expected to offload about $15.4B. Perhaps most striking: even in a rally scenario, these rule-based strategies would still sell approximately $8.7B. This isn't about investors losing confidence—it's about algorithms executing predetermined de-risking protocols.

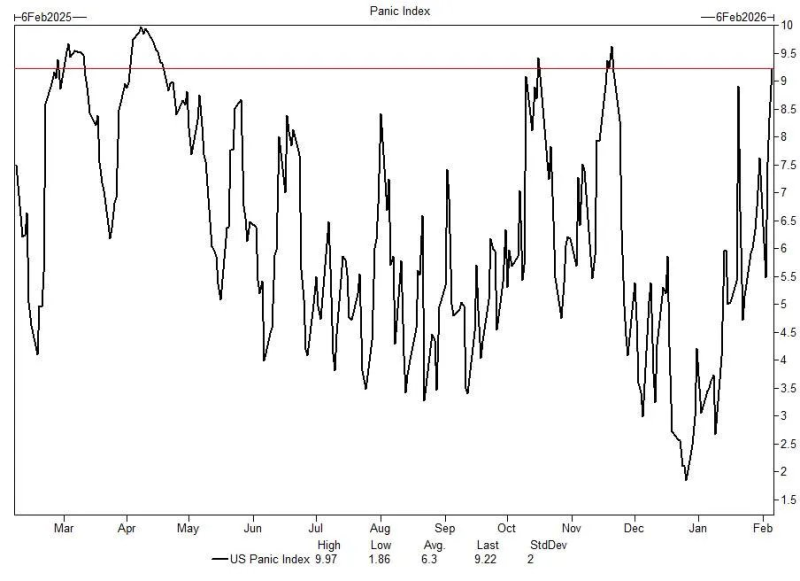

⬤ Goldman's Panic Index reached 9.22 last week, which analysts described as approaching "max fear" territory. The chart shows the index has repeatedly spiked toward its ceiling over the past year, with the latest reading sitting just below the recorded peak of 9.97.

Liquidity was thin and dealers had flipped to flat or short gamma, Goldman noted, describing market conditions where even modest order flow can trigger outsized price moves.

⬤ With systematic selling thresholds now activated and gamma positioning in fragile territory, the S&P 500 remains vulnerable to technical breakdowns at levels like 6,707. The combination of algorithm-driven pressure and elevated sentiment readings adds to recent stock market fear readings and mirrors previous episodes when S&P 500 volatility turns extreme. When positioning unwinds meet shallow liquidity, markets tend to move fast and unpredictably.

Peter Smith

Peter Smith

Peter Smith

Peter Smith