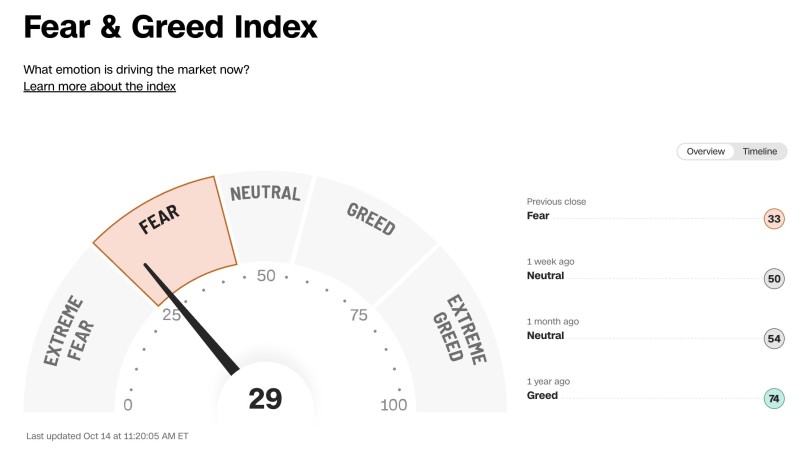

Wall Street's mood has taken a sharp turn as the Fear & Greed Index dropped to 29, pushing into "Fear" territory. This sudden shift reflects growing investor anxiety amid market volatility, economic headwinds, and rising geopolitical tensions.

Sentiment Breakdown

According to Barchart, the index is approaching "Extreme Fear" - a psychological threshold typically linked to panic-driven selling. The decline has been swift: just a week ago the reading was 50 (Neutral), while a month prior it sat at 54. Perhaps most striking is the year-over-year comparison, which showed 74 (Greed) twelve months ago.

The chart reveals a clear leftward pivot into bearish territory, with the drop from 33 to 29 in a single session highlighting how quickly confidence can evaporate. Historically, readings between 25 and 30 have marked inflection points, sometimes preceding deeper selloffs or creating entry points for contrarian investors.

What's Driving the Fear

Several factors are converging to shake investor confidence. Economic uncertainty persists as inflation remains sticky and questions linger over the Federal Reserve's policy path. Geopolitical risks continue to disrupt global trade and supply chains, while corporate earnings reports reveal cracks in consumer spending and profit margins. Meanwhile, bond market volatility and rising yields are creating additional pressure on equity valuations.

What Comes Next

A drop below 25 would signal "Extreme Fear" and could trigger sharper equity corrections. Traders may favor defensive positioning in this environment, while long-term investors might see the pullback as a chance to buy quality stocks at lower prices.

Usman Salis

Usman Salis

Usman Salis

Usman Salis