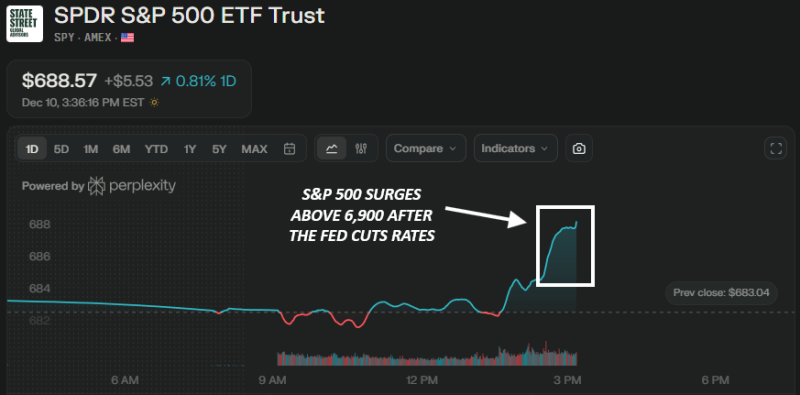

⬤ The S&P 500 surged on Tuesday after the Fed lowered interest rates and rose above 6,900 for the first time since 29 October. The SPDR S&P 500 ETF Trust SPY closed at $688.57, a gain of 0.81 %, after it hovered near $682 for most of the morning. The move brings the benchmark close to a record close even though stagflation fears remain in the background.

⬤ The chart shows that SPY hardly budged all morning then vaulted the instant the Fed released its decision. The steep rise on the right side shows how fast buyers stepped in.

The S&P 500's climb past 6,900 occurs even though stagflation worries persist, which shows that markets focused on the rate cut instead of on mixed economic data.

⬤ The speed of the reaction gives the move its weight. Trading volume jumped as SPY sliced through resistance levels, which points to broad conviction behind the rally. Markets welcomed the Fed statement and repriced risk assets higher right away.

⬤ The S&P 500 stays the main gauge of overall market health - moves of this size carry weight. When the benchmark index reacts this sharply to policy shifts, it sets expectations across bonds, commodities and other assets. Whether the momentum lasts will hinge on how the Fed's policy shift affects real economic conditions in the weeks ahead.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova