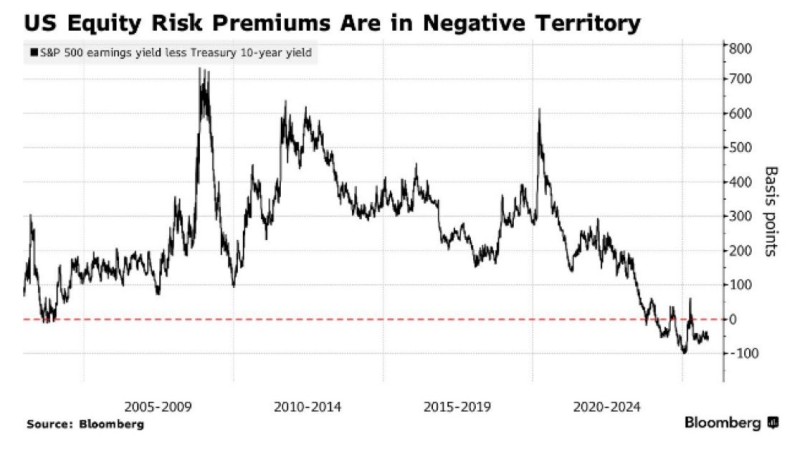

⬤ Bloomberg data reveals the U.S. equity risk premium has turned negative—a rare market event that's only happened a handful of times over the past 20 years. The spread between what you'd earn from S&P 500 companies versus risk-free Treasuries has dropped below zero, sitting somewhere between negative 50 and negative 100 basis points. In plain terms, stocks aren't paying investors enough to justify taking on extra risk anymore.

⬤ This metric has been sliding steadily since the mid-2010s, but the decline accelerated after 2021 as Treasury yields climbed while stock valuations stayed elevated. When bond yields jump, they create real competition for investor dollars—suddenly that guaranteed government return starts looking pretty attractive compared to the uncertainty of equity markets. The chart tracking this shift shows just how unusual the current setup really is.

⬤ A negative equity risk premium throws a wrench into traditional investment thinking. It raises serious questions about whether stocks are overpriced, especially when economic uncertainty is already running high. For portfolio managers and everyday investors alike, this shift could trigger a rethinking of where to put money—potentially cooling enthusiasm for high-valuation tech stocks and other equity darlings.

⬤ What happens next depends largely on how S&P 500 earnings growth stacks up against interest rate moves. If corporate profits can't keep pace with bond yields, we might see more money flowing out of stocks and into fixed income. That dynamic could reshape market sentiment and put downward pressure on the S&P 500 in the coming months, making this negative premium one of the key indicators to watch.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah