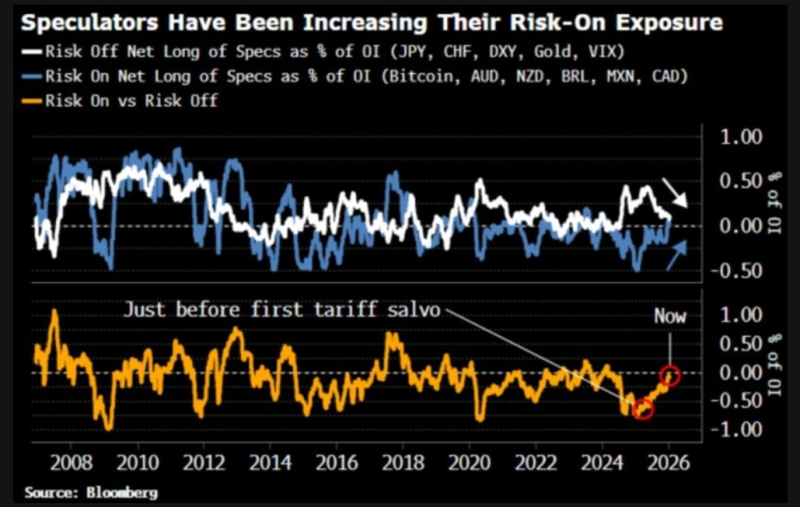

⬤ Speculative money has flooded into risk-on assets across global markets, and the imbalance is starting to look dangerous. Recent positioning data shows traders loading up on higher-risk plays while ditching traditional safe-haven positions, leaving the market badly exposed if sentiment suddenly shifts. Right now, there's little cushion if things go wrong.

⬤ The positioning gap between risk-on and risk-off trades has widened dramatically. Net long exposure has jumped in assets that thrive when investors feel confident—think Bitcoin and growth-sensitive currencies—while defensive positions in gold, the US dollar, the Japanese yen, and volatility hedges have thinned out. The combined risk indicator has bounced back from recent lows and now sits near levels that preceded past market disruptions.

⬤ What makes this setup particularly concerning is how much more vulnerable it looks compared to positioning before the first Trump-era tariff shock. Back then, speculators still had meaningful exposure to risk-off assets, which softened the blow when markets got choppy. Today's positioning offers no such protection. The data also suggests macro hedge funds and commodity trading advisors have been adding to riskier bets, based on how closely their returns now track US equity movements.

⬤ This matters because crowded trades amplify volatility when stress hits. With so much speculative capital tilted toward risk assets, even moderate escalation in geopolitical tensions or economic concerns could spark rapid unwinding. That kind of repositioning typically intensifies price swings across stocks, currencies, and crypto markets—turning positioning itself into a major force driving market action when sentiment flips.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah