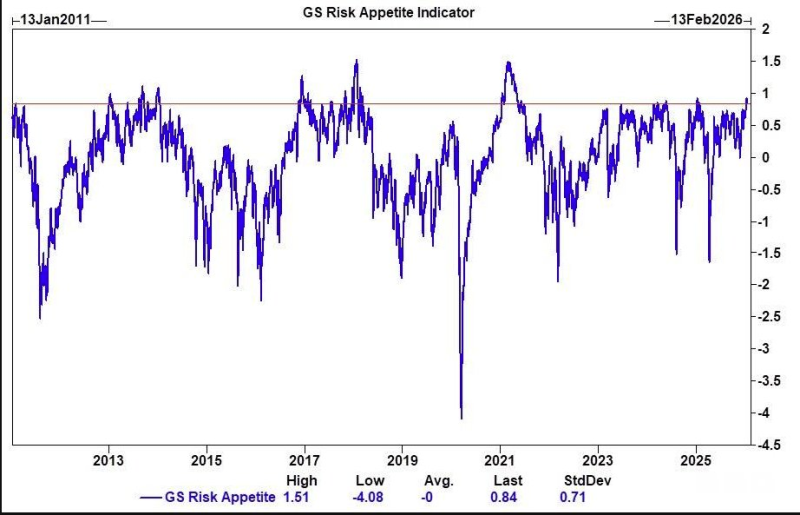

⬤ Goldman Sachs' Risk Appetite Indicator recently jumped to around 0.9 - the highest we've seen since 2025 and sitting in the 96th percentile historically. This spike shows investors are feeling pretty confident about 2026. Market conditions look favorable, and there's genuine optimism about where things are heading economically.

⬤ Here's the catch though - when risk appetite gets this high, history tells us small pullbacks tend to pop up more often. Don't panic when they happen. These dips are usually just healthy corrections, not signs that everything's falling apart. Markets running hot like this naturally see some short-term choppiness, but the overall bullish vibe could keep pushing things higher if conditions stay solid.

⬤ High risk appetite doesn't mean it's time to sell. Markets can stay optimistic way longer than you'd expect when the fundamentals support it. We've seen it before - even with elevated risk readings, markets just keep climbing and surprising everyone with how long the momentum lasts.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi