Wall Street just got served a curveball that nobody saw coming. Tuesday's inflation report delivered a confusing mix of signals that somehow convinced traders the Federal Reserve is about to start cutting interest rates. While headline inflation came in softer than expected, core prices jumped higher – creating the kind of economic puzzle that usually sends markets into a tailspin. Instead, bond traders are placing aggressive bets that Jerome Powell will blink first and start easing monetary policy as soon as September.

Wall Street's New Favorite Bet: Two Rate Cuts in 2025

The latest inflation numbers just threw everyone for a loop. We got weaker headline inflation but stronger core numbers – basically the worst of both worlds that somehow has traders thinking the Fed's about to start cutting rates.

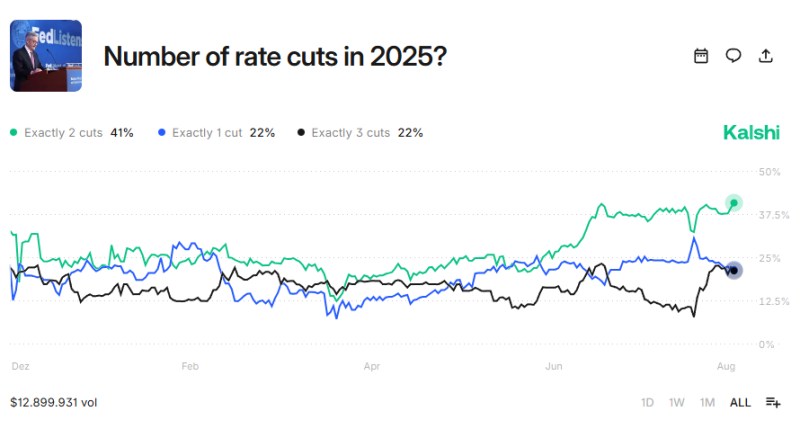

Here's what's crazy: There's now a 41% chance we'll see exactly two rate cuts in 2025. That's become the single most popular bet, beating out all other scenarios. Just a few weeks ago, many were questioning whether we'd see any cuts at all.

The math breaks down like this: 41% say two cuts, 22% betting on just one, and another 22% going for three cuts. The remaining folks are scattered across more extreme scenarios, but clearly, the smart money thinks the Fed's getting ready to ease up.

The Fed's New Reality Check

What's really telling is how markets are treating 3% inflation like it's the new normal. Nobody's panicking about missing that 2% target anymore – traders seem perfectly fine with inflation running a bit hot if it means cheaper money.

This attitude shift could be huge for Fed policy. Instead of feeling pressured to keep rates high until inflation hits exactly 2%, Powell and crew might feel comfortable cutting rates while inflation's still above target. That's a pretty big change from the hawkish stance we've been used to.

The September Fed meeting just became must-see TV. If they actually pull the trigger on a cut, it'll confirm what markets are already pricing in. But if they hold steady, expect some serious volatility as traders scramble to readjust their bets.

What This Means for Your Portfolio

Rate cuts usually mean good times for stocks and bonds, but this setup feels different. The mixed inflation signals suggest we're not out of the woods yet, so don't expect a smooth ride to lower rates.

Smart traders are watching every piece of economic data like hawks right now. The next CPI report and jobs numbers could completely flip these odds again. In this environment, staying flexible beats making big directional bets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith