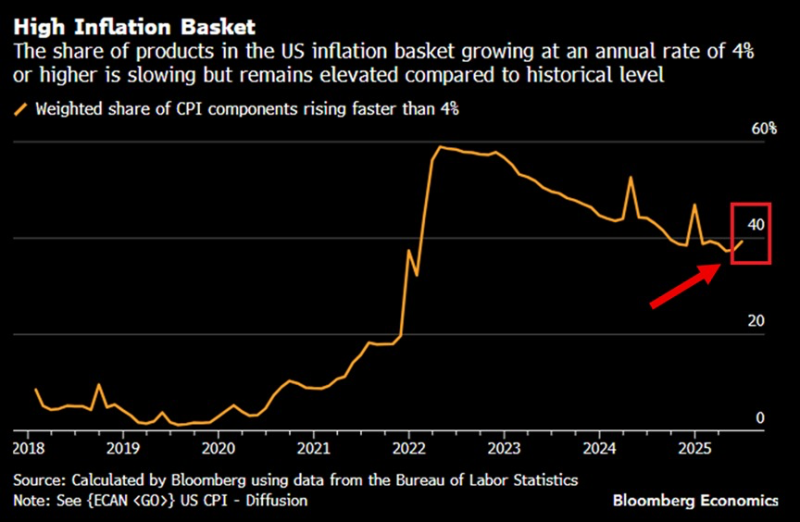

America's inflation battle might be far from over. Fresh data reveals that 40% of items in the consumer price basket are now climbing faster than 4% per year – the highest share we've seen in 2025. This isn't just another statistic; it's a red flag that price pressures are spreading across the economy like wildfire.

The numbers paint a concerning picture. While headlines celebrate cooling inflation from 2022's peaks, beneath the surface, a growing chunk of goods and services continues to experience serious price growth. This persistence suggests that getting inflation back to the Fed's 2% target might be tougher than anyone hoped.

Services Costs Explode to 20-Month Highs

The services sector is where things get really interesting – and not in a good way. The ISM Services Prices Paid index just rocketed to 69.9 points in July, hitting levels we haven't seen since November 2022. That's when inflation was still running wild and the Fed was aggressively hiking rates.

Here's why this matters: this particular gauge has a track record of predicting where overall inflation heads next. When service costs spike like this, consumer prices often follow within months. It's like watching storm clouds gather on the horizon – you know something's coming.

Fed's Rate Cut Dreams Could Evaporate

Market watchers had been getting excited about potential rate cuts later this year, but these inflation warning signs might throw cold water on those expectations. When more than 40% of price components are racing ahead at 4%+ growth rates, central bankers typically get nervous about loosening policy.

The pattern is pretty clear from past cycles: broad-based price acceleration like this often signals that inflation is gearing up for a comeback tour. If history repeats itself, we could see consumer prices start climbing again in the coming months, forcing the Federal Reserve to pump the brakes on any dovish pivot they might have been considering.

Usman Salis

Usman Salis

Usman Salis

Usman Salis