Wall Street's biggest players are making their most bearish bet in years, but Main Street isn't backing down. The latest trading data reveals a stark divide: professional hedge funds are shorting individual stocks at a pace not seen since the 2020 crisis, while everyday retail investors continue loading up on equities with record enthusiasm. Despite this tug-of-war, the S&P 500 managed to hold its ground, ending the week essentially flat.

Hedge Funds Unleash Aggressive Short Campaign

The S&P 500 caught everyone's attention last week when hedge funds dramatically ramped up their bearish bets on US stocks. These institutional traders shorted individual companies at the fastest clip since at least the 2020 market meltdown. What's remarkable? The index itself barely budged, finishing the week roughly unchanged after a solid Friday recovery.

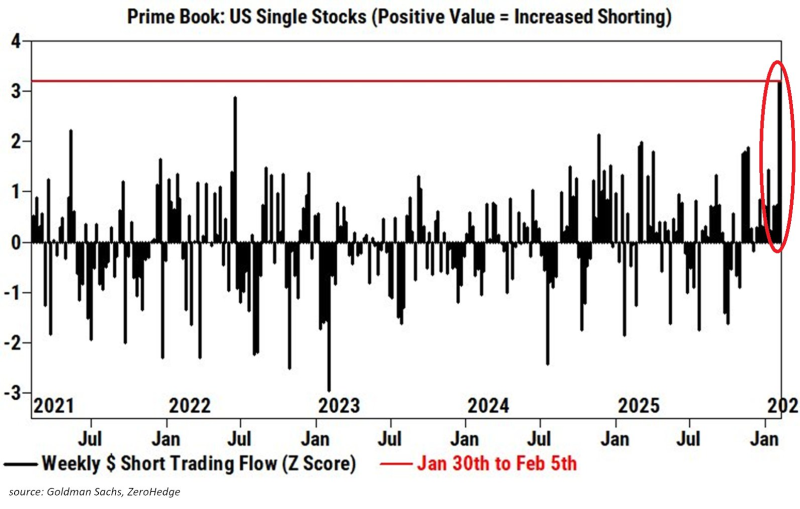

Trading flow data measured by Z score hit extreme positive territory, signaling an unprecedented surge in short-selling activity. The numbers tell a striking story—this level of bearish positioning exceeded anything we saw during April 2025's market crash and topped every week of the brutal 2022 bear market.

The magnitude of short positioning we're seeing now surpasses even the most volatile periods of recent years, creating a unique market dynamic.

Why the S&P 500 Didn't Collapse

Here's where things get interesting. While the smart money piled into shorts, retail traders did exactly the opposite. Mom-and-pop investors kept buying hedge fund positioning extremes without hesitation, now sitting on record stock exposure levels. This relentless dip-buying provided crucial support that prevented any serious breakdown.

The battle lines are clearly drawn: record retail stock ownership on one side, massive institutional shorting on the other. Yet somehow, the S&P 500 managed to stay balanced, reflecting these completely opposing forces.

What This Means for Markets

The current setup creates a fascinating standoff. Heavy institutional short activity typically signals professional concern about valuations or economic headwinds. Meanwhile, retail investors' record exposure suggests Main Street remains convinced this is just another buying opportunity.

This divergence in sentiment rarely lasts forever. Either hedge funds will get squeezed as prices move higher, or retail investors will face painful losses if the bears prove right. For now, though, these opposing flows have created an unusual equilibrium, keeping the S&P 500 locked in place while both sides hold firm to their convictions. The coming weeks will reveal which camp made the smarter call.

Peter Smith

Peter Smith

Peter Smith

Peter Smith