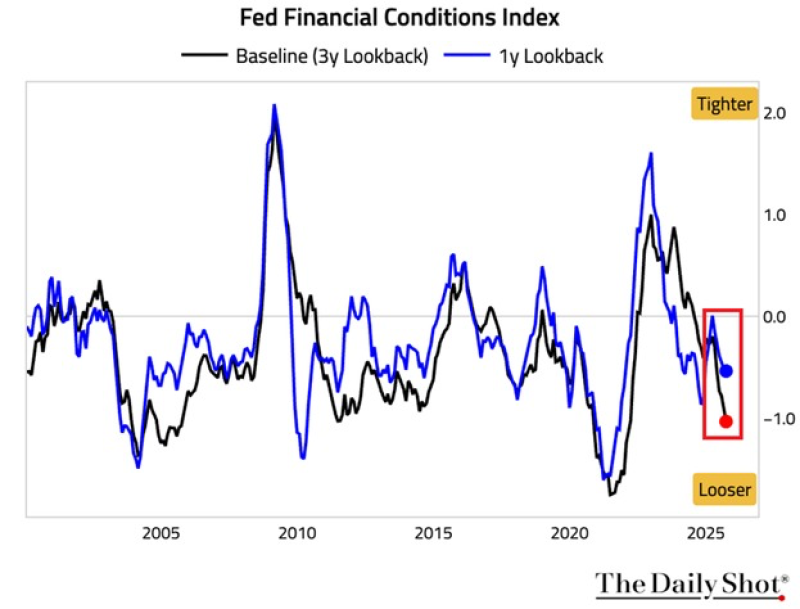

● According to The Kobeissi Letter, U.S. financial conditions have loosened significantly—reaching their easiest point in over three years. The Fed's Financial Conditions Index shows the 1-year measure at -0.5 and the 3-year baseline at -0.9, both matching levels last seen in early-to-mid 2022.

● Looser conditions—narrower credit spreads, cheaper borrowing, and rising stock prices—make money easier to access. That's generally good for growth, but it also risks reigniting inflation if spending picks up too fast. The data suggests the Fed's tightening campaign has lost much of its punch, and markets are betting rate cuts could come sooner than previously thought.

Excluding the 2020–2021 pandemic period, conditions are now at their easiest since 2011. A new era of monetary policy has arrived. As The Kobeissi Letter put it

● These readings show liquidity has bounced back to levels not seen outside the pandemic since 2011. Easier conditions typically boost corporate spending, consumer loans, and stock market confidence—all growth drivers. But they could also undermine the Fed's goal of keeping inflation near 2%, potentially forcing a more cautious approach ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith