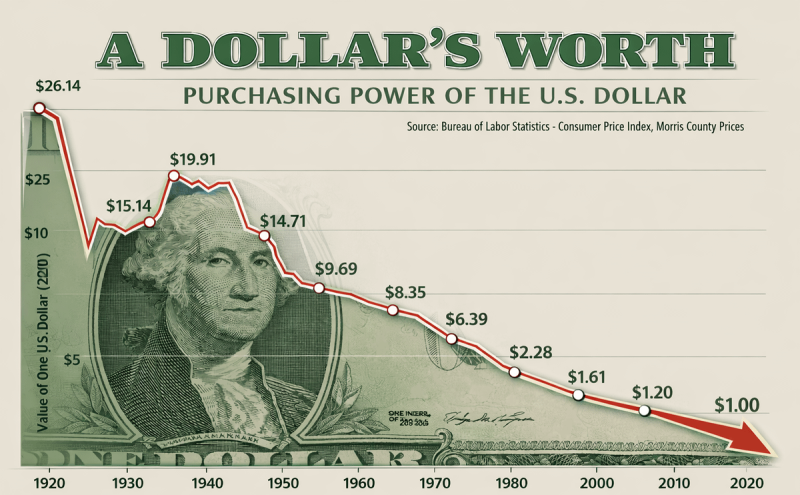

The American dollar isn't what it used to be - literally. Over the past hundred years, what once bought you $26 worth of goods now barely gets you a dollar's worth. This isn't about some dramatic market crash or economic apocalypse. It's the quiet, relentless work of inflation eating away at your money's real value, year after year, decade after decade.

The Century-Long Slide: From $26 to $1

Long-term historical data paints a sobering picture of the U.S. dollar's purchasing power erosion. Financial analyst Tracer recently highlighted how one dollar's value has declined steadily across generations, driven by cumulative inflation rather than any single economic shock.

The numbers tell a clear story. Around 1920, a single dollar packed the purchasing punch of roughly $26 in today's money. By mid-century, that had shrunk below $15. Fast-forward to the late 1900s, and you're looking at just a few dollars. Today? We're hovering around $1 in real terms - a 96% loss over a century.

The value of one dollar has declined steadily across decades, reflecting cumulative inflation rather than a single economic event or abrupt monetary shift, Tracer noted.

This gradual erosion isn't about dramatic collapses - it's inflation doing what inflation does best: slowly chipping away at what your money can actually buy. Similar dynamics played out more recently, as shown in dollar purchasing power drops 53% over just three decades.

Why Your Grandparents' Dollar Went Further

The continuous downward trajectory reflects how rising price levels systematically reduce real currency value over extended periods. It's not a bug in the system - it's a feature of how modern fiat currencies work. As goods and services cost more, each dollar buys proportionally less.

The same pattern emerges when examining US inflation 2020–2025 dollar lost value, where purchasing power weakens as prices climb faster than currency adjusts.

Structural Shift, Not Sudden Shock

What makes this data particularly striking isn't any single year's drop - it's the relentless consistency. This is a structural monetary phenomenon playing out across generations, not some overnight currency crisis. Inflation compounds quietly over time, reshaping real economic conditions without requiring dramatic market disruptions or headline-grabbing crashes.

For savers and long-term planners, the message is clear: cash loses value simply by sitting still. Understanding this century-long trend helps explain why smart money looks for inflation hedges and why holding dollars alone has historically been a losing strategy.

Peter Smith

Peter Smith

Peter Smith

Peter Smith