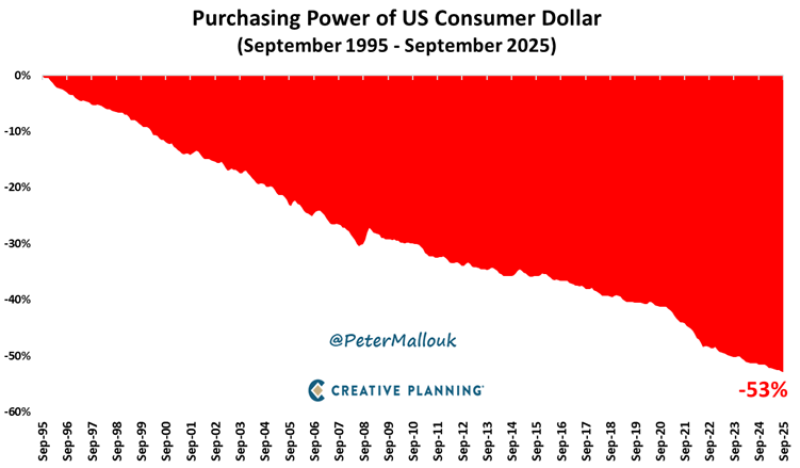

⬤ The dollar has lost 53% of its purchasing power between September 1995 and September 2025—a striking reminder of inflation's long-term bite. This isn't some fluke or crisis-driven collapse. It's the system working as designed. The accompanying chart shows a steady, uninterrupted decline over 30 years with no real bounce-back periods.

⬤ While there's no formal tax proposal tied to this data, inflation effectively acts like a continuous tax on households. It quietly chips away at real income and savings, leaving people with less buying power over time. The chart makes the cumulative damage clear—what seems like small annual losses compound into something substantial over decades.

⬤ Inflation has been called a "silent thief" for good reason. It takes value from your money whether you're actively spending it or not. Cash sitting idle loses purchasing power year after year. The 53% decline isn't an anomaly—it's a structural feature of the economy, and it underscores the gap between what your dollars say on paper and what they can actually buy.

⬤ For anyone trying to build or protect wealth, this trend is a wake-up call. Holding cash long-term means accepting guaranteed purchasing power loss. Real assets—things that can hold or grow value against inflation—become essential for maintaining financial stability. Understanding this dynamic isn't optional anymore; it's the difference between preserving wealth and watching it slowly evaporate.

Peter Smith

Peter Smith

Peter Smith

Peter Smith