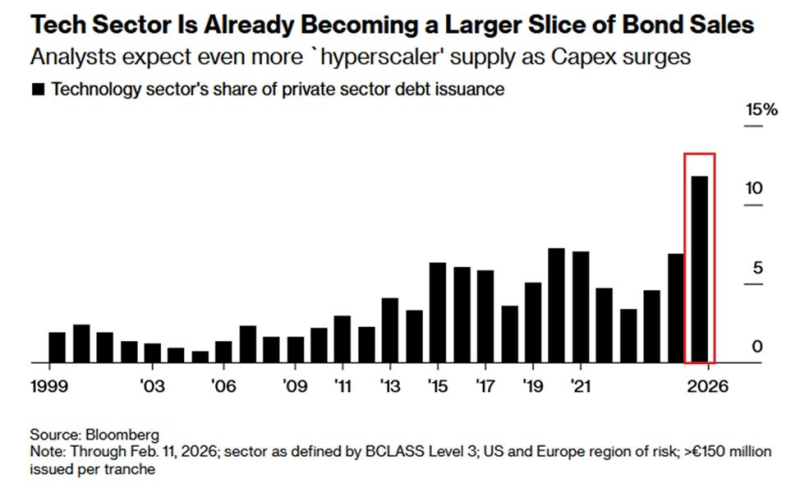

Big Tech's appetite for borrowed capital has hit unprecedented levels. The technology sector's share of corporate debt markets surged to a record 11.8% in 2026, nearly tripling from 2023 levels as companies rush to finance massive AI infrastructure projects. Alphabet's landmark bond offering stands at the center of this borrowing wave.

Tech Debt Hits All-Time High at 11.8% of Corporate Issuance

The technology sector now accounts for 11.8% of all private sector debt issuance in 2026—the highest level on record since data tracking began in 1999, according to The Kobeissi Letter. That's roughly three times the share seen in 2023 and 4.6 percentage points above the previous peak hit in 2020. The jump reflects ballooning capital requirements as tech giants scale up computing capacity and data infrastructure to support AI development, a theme explored in Alphabet shares climb higher on AI success.

The shift illustrates how financing structures in capital markets are evolving alongside the escalating funding needs tied to AI-related projects. Companies are no longer just tapping equity markets—they're leaning heavily on debt to fuel growth without diluting shareholder value.

Alphabet Issues $33B in Bonds, Including Rare 100-Year Maturity

Alphabet (GOOGL) recently closed a nearly $33 billion bond sale across three markets, marking one of the largest corporate debt offerings of the year. The company also issued a rare 100-year corporate bond—the first from a technology firm since Motorola's similar move back in 1997.

The first 100-year bond from a tech company since Motorola in 1997, the report noted, underscoring the unusual nature of the issuance.

Alphabet's aggressive capital raise ties directly to its AI expansion strategy, which has already driven significant stock momentum tracked in Alphabet stock targets $270 as breakout momentum builds. The company's valuation metrics have also shifted dramatically, as detailed in Alphabet's forward P/E hits 28.6, surpasses Nvidia in AI valuation shift.

Broader equity performance has been equally strong, with GOOG Alphabet shares extend rally 40% higher following Elliott Wave support and Alphabet (GOOG) stock smashes records, joins $3 trillion club highlighting the stock's historic run.

The growing share of technology debt issuance signals a structural shift in how Big Tech finances its next phase of growth, with AI infrastructure at the core of this borrowing boom.

Peter Smith

Peter Smith

Peter Smith

Peter Smith