⬤ U.S. stocks moved lower after fresh labor data delivered conflicting signals. January nonfarm payrolls rose by 130,000—roughly double the 65,000 estimate. But the gains were concentrated in just two sectors: healthcare added 82,000 jobs and social assistance contributed 42,000, leaving limited breadth elsewhere.

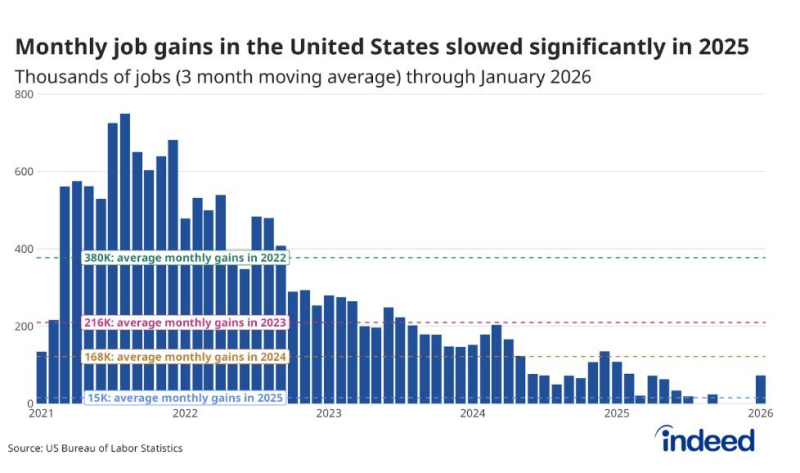

⬤ The real shock came from revisions that rewrote last year's hiring story. The BLS slashed total nonfarm payroll gains for 2025 from 584,000 down to 181,000—averaging just 15,000 jobs per month. That's a dramatic slowdown compared to prior years: 380,000 monthly in 2022, 216,000 in 2023, and 168,000 in 2024. The three-month moving average through January 2026 shows how job gains faded materially in 2025 versus earlier periods, with payroll momentum dropping to levels not seen outside recessions.

⬤ Policy expectations moved against stocks at the same time. Odds of a 25 bps rate cut for the March 18 FOMC fell to 5.9% from 20.1% a day earlier, while April 26 odds dropped to 22.3% from 36.2%. The repricing happened even as the report showed weakness under the surface, aligning the market reaction with the idea that fewer near-term cuts are being priced despite softer hiring trends.

⬤ The takeaway: markets aren't reacting to the headline beat anymore. They're focused on fading hiring momentum and what it means for policy—and right now, that combo is pushing stocks lower.

Usman Salis

Usman Salis

Usman Salis

Usman Salis