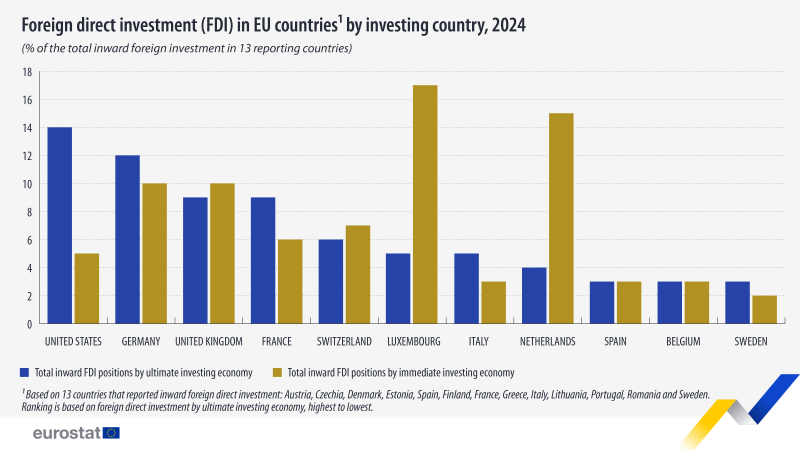

⬤ The United States accounted for 14% of total inward foreign direct investment across 13 reporting EU countries in 2024, solidifying its position as Europe's primary long-term capital provider. Luxembourg topped immediate investment flows at 17%, leveraging its status as a financial gateway for multinational investments entering the EU.

⬤ Ongoing EU tax reforms targeting profit-shifting and intermediary jurisdictions have sparked concerns about their impact on cross-border capital flows. Potential risks include divestment pressures, increased compliance costs, and talent migration from sectors dependent on multinational structures. Some analysts worry that sudden policy shifts could force corporate restructuring or even push vulnerable firms toward insolvency if access to favorable financial channels narrows.

⬤ Understanding the gap between ultimate and immediate investors is crucial—countries like Luxembourg and the Netherlands frequently serve as intermediaries through holding companies rather than true capital sources. The actual investment origins often trace back to Germany, France, the UK, and Switzerland. This layered structure explains why immediate and ultimate investor rankings diverge significantly, making careful analysis essential for sound policymaking.

⬤ The 2024 figures underscore both the resilience and complexity of Europe's investment ecosystem amid shifting geopolitics, evolving supply chains, and tax policy changes. While US dominance in ultimate investment and Luxembourg's lead in immediate flows remain clear, the future hinges on whether the EU can balance tax fairness with maintaining its appeal to global capital.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi