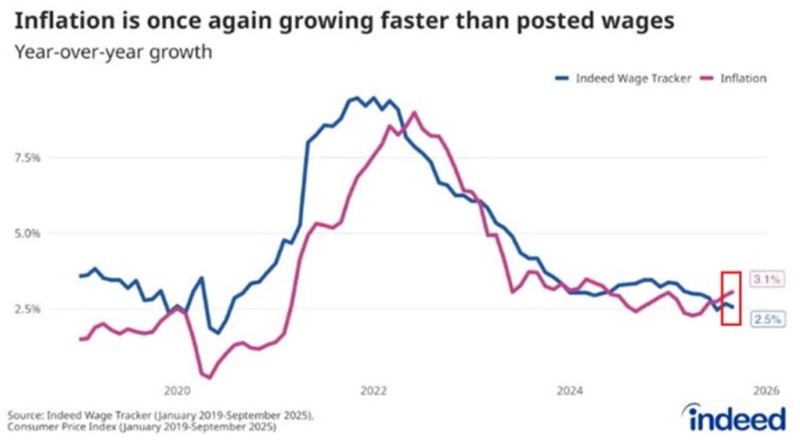

⬤ The latest numbers from the Indeed Wage Tracker reveal a concerning slide in US wage growth, highlighting a shift in the balance between pay increases and rising prices. Posted wages grew just 2.5% year over year in October, marking the lowest growth rate since July 2020. If you exclude the pandemic period, this is the weakest wage growth we've seen in at least seven years. The data shows wage growth has now dropped below the inflation rate, reversing the brief catch-up we saw earlier in 2024.

⬤ Wage gains have been steadily decelerating from their peak of 9.5% back in January 2022. That earlier surge came from tight labor markets and aggressive hiring during the post-pandemic recovery. Since then, wage growth has been trending downward for over two years, slipping under 3% through 2024 and hitting 2.5% by late 2025. Meanwhile, inflation has turned higher again, climbing to 3.1% year over year. This crossover marks the return of negative real wage growth—meaning paychecks aren't keeping up with the cost of living.

⬤ The gap reflects renewed price pressures that aren't being matched by pay increases. After inflation cooled down from its 2022 highs, prices started rebounding in mid-2025, pushing inflation above wage growth rates. For households, this means each month's paycheck buys less than before, bringing back financial pressures that had temporarily eased earlier in the cycle.

⬤ This shift matters because real wage losses directly hit household spending power, which drives a huge chunk of economic activity. When inflation outpaces wages, consumers face tighter budgets, which can impact retail sales, service sector performance, and overall consumption. The renewed gap between inflation and wages could also shape economic expectations heading into 2026.

Usman Salis

Usman Salis

Usman Salis

Usman Salis