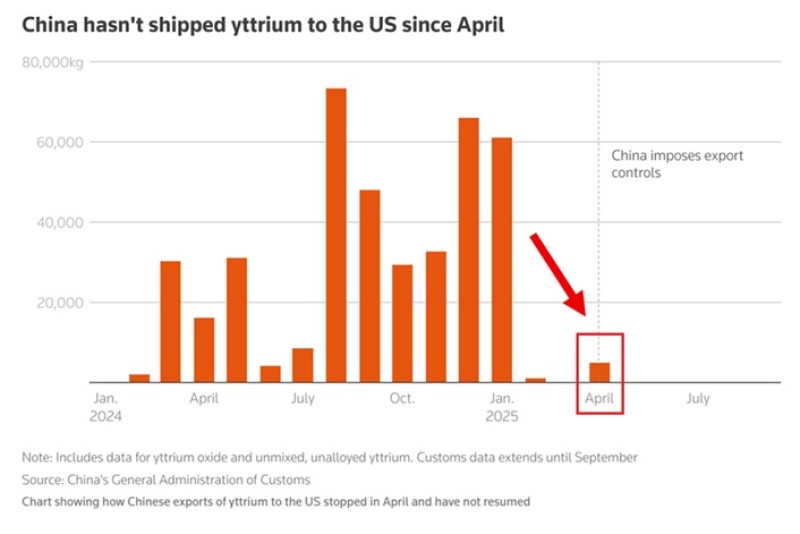

⬤ China completely stopped shipping yttrium to the United States starting in April, and the freeze has now lasted seven months. The shutdown came right after Beijing rolled out new export controls on rare earth metals. Before the restrictions kicked in, monthly shipments were flowing steadily throughout early 2024. Then they dropped to zero overnight and haven't recovered since.

⬤ The numbers tell a stark story about America's supply chain vulnerability. The US previously relied on China for 93% of its yttrium, with the remaining 7% coming from Chinese-processed sources. That means virtually all of America's yttrium supply came from one country. Now that the tap has been turned off, stockpiles are running dry fast. One rare earth trader watched their inventory crash from 200 tons down to just 5 tons this year. Industry experts estimate current US stockpiles will only last somewhere between 1 and 12 months. Meanwhile, China has also cut its yttrium exports to the rest of the world by roughly 30%, squeezing global supplies across the board.

⬤ This isn't just about any industrial metal. Yttrium is absolutely critical for advanced technology and defense systems. It's a key ingredient in high-temperature superconductors, jet engines, missile guidance systems, precision lasers, protective coatings for extreme environments, and specialized ceramics that can withstand incredible heat. Without a steady yttrium supply, manufacturing these systems becomes difficult or impossible. The complete absence of shipments since April highlights just how tight China's grip is on this strategic resource.

⬤ The extended supply freeze reveals a serious weak point in America's industrial backbone during a period of rising economic and geopolitical tensions. US manufacturers and defense contractors are feeling the squeeze as their yttrium reserves dwindle. The situation is likely to push companies and policymakers toward finding alternative suppliers, ramping up domestic production efforts, and building larger strategic reserves. But those solutions take time, and right now the supply disruption shows no signs of ending.

Usman Salis

Usman Salis

Usman Salis

Usman Salis