While headline retail numbers have climbed in recent years, a closer look at inflation-adjusted data tells a starkly different story. Real retail sales—the true measure of consumer purchasing power—have barely budged since 2020, highlighting how much of the reported growth has been driven purely by price increases rather than actual volume gains.

Inflation Masks Five Years of Flat Consumer Spending

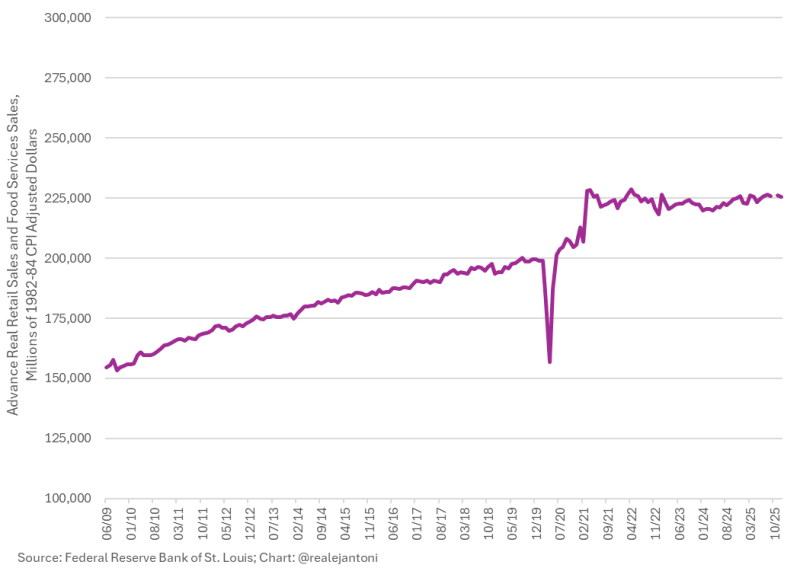

A comprehensive chart of U.S. real retail sales reveals limited net progress over the past several years, confirming that headline spending gains have been dominated by price effects rather than genuine volume growth. According to recent analysis, retail sales "haven't increased in almost 5 years" when adjusted for inflation, with the pattern expected to shift this year.

The data series, labeled "Advance Real Retail Sales and Food Services" in CPI-adjusted dollars, shows steady growth from 2009 through 2019 before a sharp pandemic-related drop in 2020 and subsequent rapid rebound. What happened next is telling: the line flattens dramatically through 2021–2025, hovering around the low-to-mid 200,000s (in millions of CPI-adjusted dollars). Put simply, real retail sales have moved sideways even as nominal receipts climbed during an inflation-heavy stretch.

The pattern shows retail sales haven't increased in almost 5 years and have largely reflected inflation, with hopes that shifts this year.

Why Real vs. Nominal Sales Matters for Markets

This visual pattern underscores how inflation can lift reported sales totals without meaningfully increasing inflation-adjusted economic activity. When real retail sales trend sideways, it signals that higher prices are doing most of the heavy lifting in headline growth while the inflation-adjusted baseline stays comparatively flat. Related context on inflation and price dynamics is covered in US inflation holds at 2.55%.

The gap between nominal gains and real retail sales levels carries serious implications for market interpretation, especially when assessing spending strength during elevated inflation periods. For deeper insights into inflation-driven distortions, see Wholesale inventories show inflation's hidden effect and US wage growth drops to 2.5% while inflation climbs to 3.1%.

Understanding this distinction helps investors and policymakers separate actual economic momentum from the illusions created by rising price levels alone.

Peter Smith

Peter Smith

Peter Smith

Peter Smith